This is SpareBank 1 SMN

The first savings banks in Norway saw the light of day in the 1820s, and our history extends 200 years back in time to the founding of Trondhjems sparebank in 1823.

A group of Trondheim’s better-off men paid a total of 1,596 speciedaler to set up a local savings bank. The bank they founded was named Trondhjems sparebank. Little did those men know that this was to be the start of a long and proud history.

Between the 1820s and far into the 1900s new savings banks were established across the entire region. In the 1990s and subsequently, many of them were amalgamated with what was once Trondhjems sparebank. It is these banks that now make up SpareBank 1 SMN. The men who back in the day founded Trondhjems sparebank aspired to build their community and to play a part in helping the less well-off to accumulate savings. They wanted the community to own the bank, and as early as 1840 Trondhjems sparebank started to devote parts of its net profit to supporting projects that would benefit the local populace.

Now that we are entering the anniversary year 2023 to celebrate a 200-year history, we are much more than a bank. We are the region’s leading financial services group and can offer our customers a comprehensive and coherent range of products and services in the banking, accounting and estate agency spheres.

The set of values dating from 1823 has been with us throughout our history and stands firm to this day. Our main objective is, and has always been, to provide good financial advice to people and businesses in good and bad times. The community is still the group’s largest stakeholder and each year receives its rightful share of the net profit through the community dividend fund.

We have a big heart for the local communities across our region, and an unwavering belief that Together we make things happen.

Goals and strategic priorities

SpareBank 1 SMN’s aspires to be the leading financial services group in Mid-Norway, and among the best performers in the Nordic region. We aim to create financial value, to build the regional community and to assume our share of the responsibility for a sustainable development.

With our strong customer relationships and high return over time, we have a good foundation on which to build further. We have clear-cut objectives in terms of profitability, financial position and efficiency. In relation to the fourth quarter 2022 the goal related to return on equity was increased, and the annual cost-goal was revised. Our goals for the coming period are:

- Profitable, with a 13 per cent return on equity

- Financially solid, with a CET1 ratio of 17.2 per cent. Payout ratio about 50 per cent

- Efficient. Annual goal of a cost-income ratio below 40 per cent at the parent bank, and below 85 per cent at subsidiaries

- Responsible. Achieve net zero emissions by 2050

- Strengthened market position. Ambition to be number 1 in the group’s areas of business

- Increase in satisfied customers. Ambition to have the most satisfied customers in all business lines and market areas

- Proud and committed employees. Ambition to have the most committed staff in the financial industry in Norway

- Quality in all our work

Our five most important priorities

In 2020 five strategic priorities were highlighted as particularly important for the group. These areas have subsequently laid the basis for our strategic priorities and will continue to do so in 2023.

The five priorities are:

- Create ‘One SMN’ through improved interaction between support functions, business lines and subsidiaries

- Increase digitalisation and use of insight to ensure relevant and future-oriented solutions

- Take a leading role in the development of Norway’s savings banks by challenging partners and competitors alike and exploiting the developmental power present in SpareBank 1-alliansen

- Integrate sustainability into the business and stimulate sustainable development of Mid-Norway by being a driver for the green transition, a partner for the inclusive development of society and a guide for responsible business culture.

- Exploit the power inherent in our ownership model to instil pride and commitment among employees and the populace in general, through contributing to the region’s development and value creation

SpareBank 1 SMN’s organisational set-up

We are an independent regional savings bank and the region’s leading financial services group. Together with our subsidiaries and affiliates, we are a complete financial centre catering to both the retail and the corporate market. With subsidiaries included, we have about 1,650 employees at the end of 2022.

SpareBank 1 SMN is one of six owners of SpareBank 1-alliansen. Through this alliance we offer competitive products in the fields of financing, savings and investment, insurance and payment services along with estate agency, leasing, accounting services and capital market services.

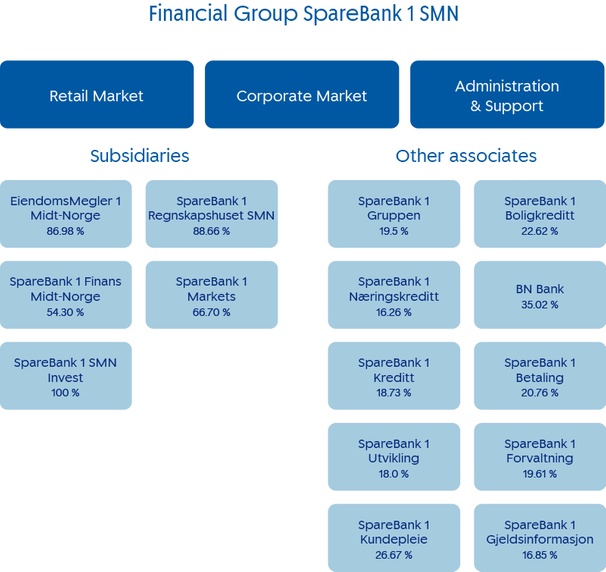

SpareBank 1 SMN is organised under the following structure:

Figure 1: Overview of business lines in SpareBank 1 SMN

Our head office is located in Trondheim and the group has altogether 68 offices across the region.

Some of these offices are stand-alone and in many localities two business lines are co-located under the same roof. 15 offices are what we term finance centres in which banking, accounting and estate agency businesses are present in one and the same location.

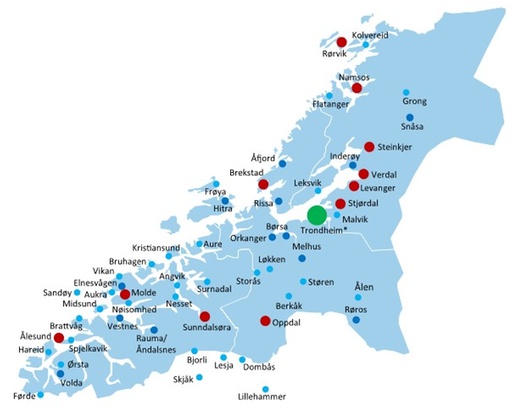

Where to find us:

Figure 2: Overview of SpareBank 1 SMN´s offices

- The group’s head office is located in Trondheim along with a number of offices offering banking, accounting and estate agency services on a stand-alone or co-located basis.

- Locations marked with red dots offer banking, estate agency and accounting services.

- Locations marked with dark blue dots offer two business lines under the same roof.

- At locations marked with pale blue dots, offices are stand-alone.

- SpareBank 1 Markets and SpareBank 1 Regnskapshuset SMN also have offices in Oslo.

Subsidiaries

EiendomsMegler 1 Midt-Norge

EiendomsMegler 1 Midt-Norge is a subsidiary of SpareBank 1 SMN. Other owners are SpareBank 1 Nordmøre and SpareBank 1 Sunnmøre. EiendomsMegler 1 Midt-Norge owns Brauten Eiendom and is part of EiendomsMegler 1-alliansen, the country’s largest provider of estate agency services. The company has more than 270 employees distributed across more than 30 offices throughout Trøndelag and Møre and Romsdal, and offers services as regards second-hand homes, commercial property and new builds along with rental and agricultural brokerage services.

SpareBank 1 Regnskapshuset SMN

SpareBank 1 Regnskapshuset SMN is a subsidiary of SpareBank 1 SMN. Other owners are SpareBank 1 Søre Sunnmøre, SpareBank 1 Gudbrandsdal and SpareBank 1 Lom og Skjåk. SpareBank 1 SMN is the largest owner and the company has some 520 employees dispersed across 42 locations in Trøndelag, Møre og Romsdal and Innlandet. The company is a fully fledged finance and technology centre and is one of the three largest operators in the accounting industry in Norway. In addition to traditional accounting services and systems the company offers services in the fields of sustainability reporting, HR, transfer of ownership, taxes and duties, and IT. In cooperation with SpareBank 1 SMN it also offers the service ‘Banking+Accounts’ which enables a business to manage its entire finances in one place.

SpareBank 1 Finans Midt-Norge

SpareBank 1 Finans Midt-Norge is a subsidiary of SpareBank 1 SMN. Other owners are Sparebanken Sogn & Fjordane, SpareBank 1 Sørøst-Norge, SpareBank 1 Østfold-Akershus, SpareBank 1 Nordmøre, SpareBank 1 Søre Sunnmøre, SpareBank 1 Hallingdal Valdres, SpareBank 1 Gudbrandsdal and SpareBank 1 Lom og Skjåk. The company offers leasing, corporate loans, vendor’s lien and invoice sale services to about 37,500 retail customers and 5,800 corporate clients. The company markets its products through parent banks, car dealers and direct sales. SpareBank 1 Finans Midt-Norge has total assets of NOK 12bn and is represented in the counties of Trøndelag, Møre and Romsdal, Vestland, Vestfold and Telemark, and Innlandet and Viken.

The proportion of financed objects with electric transmissions is growing strongly in the retail and corporate market alike. The company’s credit policy sets clear guidelines for various requirements on businesses, products and sectors and takes particular account of sustainability so as to set the stage for customers to go for more sustainable options when procuring new objects.

SpareBank 1 SMN Invest

SpareBank 1 SMN Invest is a wholly owned subsidiary of SpareBank 1 SMN, and holds shares and units in regional growth companies and funds. Activity in the company has been reduced, and it will not be making new investments. The portfolio will accordingly be scaled back over time. The company holds shares worth NOK 506m at the end of 2022.

SpareBank 1 Markets

SpareBank 1 Markets is at the end of the reporting period a subsidiary of SpareBank 1 SMN. On 22 June 2022 SpareBank 1 SMN announced that SpareBank 1 Markets was to strengthen its focus on the capital market. SpareBank 1 SR-Bank and SpareBank 1 Nord-Norge were to transfer their capital market business to SpareBank 1 Markets, and in addition buy into the company in the form of a cash payment. Upon completion of the transaction SpareBank 1 SMN will hold 39.4 per cent and SpareBank 1 Markets will be treated as an affiliated enterprise. The transaction requires approval by the Financial Supervisory Authority and the Competition Authority, and is scheduled to go ahead in second quarter of 2023.

SpareBank 1 SMN Markets AS is an investment firm offering a complete range of products. The company’s aspires to be a leading Norwegian capital market institution able in collaboration with its parent banks to deliver all capital market services. Advisory services and facilitation of external and equity financing for clients are important service areas. Client trading and proprietary trading in shares and derivatives, fixed income and currency instruments along with bonds is also undertaken. SpareBank 1 SMN holds a 66.70 per cent stake in the company.

SpareBank 1 Markets strengthened its market position in 2022. The year brought high incomes in particular in investment banking and stockbroking. Collaboration with the parent banks was good, generating incomes in all business areas. SpareBank 1 Markets has acquired a substantial position for raising capital for technology companies and companies that contribute to a sustainable economy. In total, the company participated in stock issues in a nominal amount of NOK 11.6bn (35bn), and bond issues worth a nominal NOK 8.4bn (6.9bn) in these sectors. At the end of 2022 the company had 168 employees.

SpareBank 1-alliansen’s companies

SpareBank 1-alliansen consists of 13 independent savings banks that collaborate on a shared platform and brand. The collaboration is organised through the jointly owned companies SpareBank 1 Gruppen and SpareBank 1 Utvikling with subsidiaries, in addition to a number of companies directly owned by the SpareBank 1 banks.

SpareBank 1 SMN’s has a stake of 19.5 per cent in SpareBank 1 Gruppen. SpareBank 1 Gruppen wholly owns SpareBank 1 Forsikring, SpareBank 1 Factoring and SpareBank 1 Spleis. SpareBank 1 Gruppen holds a 65 per cent stake in Fremtind Forsikring and 50 per cent of Kredinor. In addition, SpareBank 1 SMN, together with other SpareBank1 banks, directly owns SpareBank 1 Boligkreditt, SpareBank 1 Næringskreditt, SpareBank 1 Kreditt, SpareBank 1 Betaling, SpareBank 1 Forvaltning and BN Bank.

Previous

Previous