Equity capital certificate

At the end of 2022 SpareBank 1 SMN’s equity certificate (EC) capital totalled NOK 2,597m distributed on 129,387.801 ECs with a nominal value of NOK 20 each. At the turn of the year the group had a treasury holding of ECs totalling NOK 11m distributed on 550,785 ECs.

| Equity Certificates (EC) | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

| Quoted price | 127.40 | 149.00 | 97.60 | 100.20 | 84.20 | 82.25 | 64.75 | 50.50 | 58.50 | 55.00 |

| No. of ECs issued, million | 129.29 | 129.39 | 129.39 | 129.30 | 129.62 | 129.38 | 129.83 | 129.83 | 129.83 | 129.83 |

| Market value (NOKm) | 16,471 | 19,279 | 12,629 | 12,956 | 10,914 | 10,679 | 8,407 | 6,556 | 7,595 | 7,141 |

| Dividend per EC | 6.50 | 7.50 | 4.40 | 6.50 | 5.10 | 4.40 | 3.00 | 2.25 | 2.25 | 1.75 |

| Book value per EC | 109.86 | 103.48 | 94.71 | 90.75 | 83.87 | 78.81 | 73.26 | 67.65 | 62.04 | 55.69 |

| Profit per EC | 12.82 | 13.31 | 8.87 | 12.14 | 9.97 | 8.71 | 7.91 | 7.02 | 8.82 | 6.92 |

| Price-Earnings Ratio | 9.94 | 11.19 | 11.01 | 8.26 | 8.44 | 9.44 | 8.19 | 7.19 | 6.63 | 7.95 |

| Price-Book Value Ratio | 1.16 | 1.44 | 1.03 | 1.10 | 1.00 | 1.04 | 0.88 | 0.75 | 0.94 | 0.99 |

| Payout ratio | 53.6 | 53.6 | 50 % | 54 % | 51 % | 50 % | 38 % | 25 % | 25 % | 25 % |

| EC fraction | 64.0 % | 64.0 % | 64.0 % | 64.0 % | 64.0 % | 64 % | 64.0 % | 64.0 % | 64.6 % | 64.6 % |

Stock price compared with OSEBX and OSEEX

1 Jan 2021 to 31 Dec 2022

OSEBX = Oslo Stock Exchange Benchmark Index (rebased)

OSEEX = Oslo Stock Exchange ECC Index (rebased)

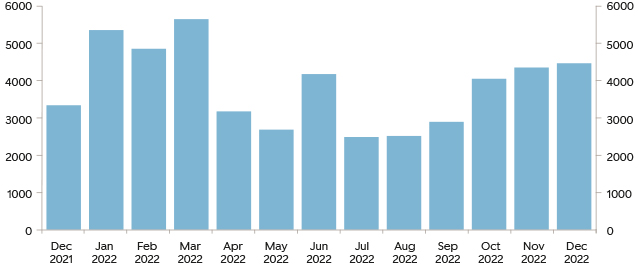

Trading statistics

1 Dec 2021 to 31 Dec 2022

Total number of ECs traded (1000)

| 20 largest ECC holders | No. Of ECCs | Holding |

| Sparebankstiftelsen SMN | 3,965,391 | 3.05 % |

| State Street Bank and Trust Comp | 3,188,662 | 2.46 % |

| VPF Odin Norge | 2,987,707 | 2.30 % |

| Pareto Aksje Norge VPF | 2,903,393 | 2.24 % |

| Pareto Invest Norge AS | 2,761,418 | 2.13 % |

| KLP | 2,738,645 | 2.11 % |

| J. P. Morgan Chase Bank, N.A., London | 2,555,343 | 1.97 % |

| VPF Eika Egenkapitalbevis | 2,540,860 | 1.96 % |

| State Street Bank and Trust Comp | 2,335,792 | 1.80 % |

| Danske Invest Norske Aksjer Institusjon II. | 2,310,642 | 1.78 % |

| VPF Alfred Berg Gamba | 2,124,217 | 1.64 % |

| VPF Nordea Norge | 2,025,266 | 1.56 % |

| Forsvarets personellservice | 2,014,446 | 1.55 % |

| J. P. Morgan SE | 1,802,526 | 1.39 % |

| Spesialfondet Borea Utbytte | 1,789,621 | 1.38 % |

| RBC Investor Services Trust | 1,527,586 | 1.18 % |

| MP Pensjon PK | 1,352,771 | 1.04 % |

| J. P. Morgan SE | 1,262,576 | 0.97 % |

| VPF Nordea Avkastning | 1,185,237 | 0.91 % |

| VPF Holberg Norge | 1,166,605 | 0.90 % |

| The 20 largest ECC holders in total | 44,538,704 | 34.30 % |

| Others | 85,297,739 | 65.70 % |

| Total issued ECCs | 129,836,443 | 100.00 % |

Dividend policy

SpareBank 1 SMN aims to manage the Group’s resources in such a way as to provide equity certificate holders with a good, stable and competitive return in the form of dividend and a rising value of the bank’s equity certificate.

The net profit for the year will be distributed between the owner capital (the equity certificate holders) and the ownerless capital in accordance with their respective shares of the bank’s total equity capital.

SpareBank 1 SMN’s intention is that up to one half of the owner capital’s share of the net profit for the year should be disbursed in dividends and, similarly, that up to one half of the owner capital’s share of the net profit for the year should be disbursed as gifts or transferred to a foundation. This is on the assumption that capital adequacy is at a satisfactory level. When determining dividend payout, account will be taken of the profit trend expected in a normalised market situation, external framework conditions and the need for tier 1 capital.

Previous

Previous