Retail Banking

The business area Retail Banking offers advice to retail customers, farm sector customers, clubs, associations and one-person businesses. Together with product suppliers and subsidiaries, the bank can offer all products that are important in making customer finances simpler and securer and in finding solutions together with the customer. Advice offered is based in the customer’s needs. Although production tasks and solutions are becoming increasingly digital, we believe there is a large and unmet need for advice and a sense of security in financial choices among all customer groups of this business area.

Although our dialogue with the customer no longer involves a physical meeting, we see the value of decentral localisation that gives the customer an opportunity to meet us face to face, and to feel that that we are something more and different than the sum of our products.

In addition to following the industry’s norms and requirements on good advisory practices, we must as a bank contribute knowledge and insight that continuously improve the quality and relevance of advisory content to our customers. Our hallmark is our ability to meet an ever larger part of our customers’ needs for financial services in an industry in which many actors focus on selling individual products.

Customers and market position

In 2016 SpareBank 1 SMN has strengthened its position as the leading actor in all Retail Banking’s customer groups, and all product areas. More than 52,000 planned customer advisory sessions have been completed in 2016, and this number is expected to increase further. The residential mortgage portfolio continues on a positive trend.

Our business has a strong standing among our customers, and shows an excellent trend in customer satisfaction. The interaction with subsidiaries, Corporate Banking and the Norwegian Confederation of Trade Unions (LO) is important in enabling Retail Banking to attain the division’s goal of continued growth in activity and the customer base.

Financial developments

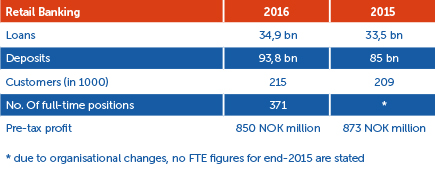

Retail Banking posted an overall pre-tax profit of NOK 850m.

The loan book shows high growth, but at consistently low risk. The increase in growth in 2015 is largely down to new borrowers coming from banks that have made structural changes, and no longer offer locally based advice. In addition to an unprecedented customer influx, we have also seen a good trend in sales across a broader range of products, and have positive expectations of growth in sales in 2017 too.

We anticipate greater uncertainty in the housing market in the period ahead, and this may have a bearing on risk in the industry. Back in March 2016 we made changes to our credit practice in order to be well prepared should house prices level off or fall. The region has a robust industry composition, and the bank has in addition focused its retail banking business on smaller loans and home financing. This makes for good risk diversification in the event of a turnaround in the economy.

In 2016 we have devoted much attention to ensuring the right activity in all functions in all channels. For example, the number of meetings with customers and outgoing activity have shown an excellent trend. In 2016 we achieved an unprecedentedly high customer influx of 15,000 new customers. This, combined with a relatively low outflow of 5,500 customers, brought a creditable net growth in the customer base.

We achieved a lending growth of all of 10.7 per cent. What distinguishes last year's growth from more normal years is that a higher proportion of the growth is down to new customers. Some competitors' decision to close offices in parts of our region gave us an opportunity to bring in good, solid customers with good risk profiles – and we grasped that opportunity. The increased activity has also been devoted to enhancing product coverage across our 215,000 retail customers. A good trend in product sales across all channels was noted 2016.

We believe that maintaining a strong local presence with relations to our customers will give the bank a business edge. On a general level we will develop a splendid digital bank staffed by competent customer advisers in many, but cost-effective, locations across our region. Customer recruitment is one effect, but we also see that it has provided and will continue to provide us with even stronger advantages in terms of developing product coverage, long-lasting customer relationships, positive margins, ensuring a better basis for delivering services and relevant initiatives and achieving higher customer satisfaction. Our customer relationship strength also contributes to increased sales via the customer centre and digital channels.

We will further develop the interaction between the physical, digital and remote channels, focusing on removal of pain points for the customer and providing greatest possible value for the customer. This means simplification and delivering on the customer's expectations on all aspects from day-to-day banking, response time and service to relevant initiatives and competent advisory service. We will make it easier for customers to resolve their needs digitally, while having competent advisers available to customers as and when needed, and for advisers to identify customer needs and provide competent advice. We will continue to streamline internal processes with a view to cost effectiveness, but not least to free up time that can be devoted to customers.

The result, in the future as at present, will be that we recruit many, and appropriate, customers, strengthen cross-sales and synergies with other parts of the group, enhance product coverage, see little customer loss, deliver one service expectations, enjoy high customer satisfaction – and by this means the chief best profitability.