This is SpareBank 1 SMN

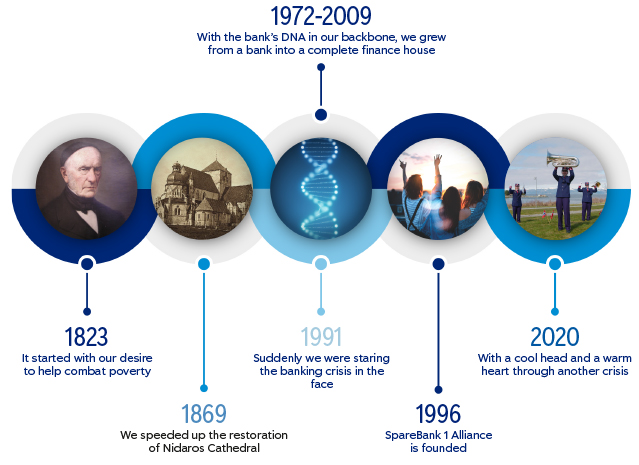

The year was 1823. There was much poverty and need in the country. 44 of Trondhjem’s most prominent men resolved to raise capital for a common fund – for the purpose of starting a savings bank for the town’s entire populace. The sum of 1,596 speciedaler was duly collected, and Trondhjem Sparebank was founded on 26 May 1823.

It was not those bank’s 44 founders that took the reins of ownership. They wanted the community to own the bank. The objects clause reflected what they wished to achieve for their community:

“…to encourage the common people to save so that the less fortunate might have something to engage in by starting a business, entering into marriage, in time of distress or in troublesome old age.”

The bank’s first manager was Jacob Roll, later to become the town’s first mayor. Over the next hundred years savings banks were founded across the entire region. In the past 30 years many of these savings banks have been amalgamated with Trondhjems Sparebank, and now make up SpareBank 1 SMN. In 1996 the regional savings banks further bolstered their standing by establishing a joint, nationwide alliance. All the banks that now make up the national SpareBank 1-allianse benefit from their shared developmental power, while maintaining an undisputed local footing and independence.

Thus starts the story of an enterprise that was to prove to be more than a bank – and its journey to what is today SpareBank 1 SMN.

The set of values that took root in 1823 remain in force at SpareBank 1 SMN, in upturns as well as downturns in the region. The community is still the largest owner, and providing good financial advice to secure the everyday finances of people and businesses remains the key objective.

Vision and values

The companies making up the SpareBank 1 SMN group currently embrace differing visions and values. In the strategy period to 2023 our ambition is to assemble the entire group under the same vision and values.

"Together we make things happen" is the vision of SpareBank 1 SMN today, with the aim of creating energy, results, change and development. Together is the opening word, which is no coincidence. It acknowledges that everyone achieves greater success working together with others. With colleagues, customers, suppliers, partners and other local and regional resources. By building relations and teaming up. Making things happen is about creating energy, results, change and development.

SpareBank 1 SMN’s values are:

- Wholehearted: It is wonderful being together with committed people, and nothing is more inspiring than working with wholehearted colleagues. There is a force and passion in a wholehearted person.

- Responsible: Integrity, credibility, trust, broadmindedness and knowledge are all important qualities. At SpareBank 1 SMN they are summed up in one word: Responsible. Being responsible is to say ‘yes’ when it is right to do so and ‘no’ when necessary.

- Likeable: Someone who is positive is also easy to like. SpareBank 1 SMN’s staff members are down-to-earth and unpretentious. They are the ‘real deal’ and on the customer’s side.

- Capable: Capable people are matter-of-fact and have no need to toss around grandiose terms and concepts. They exude professionality and competence without setting themselves apart. Capable people win customers’ confidence.

Strategic direction towards 2023

SpareBank 1 SMN aspires to be the leading financial group in Central Norway, and among the best performers in the Nordic region. SpareBank 1 SMN aims to create financial value, build the regional community and assume its share of the responsibility for sustainable development.

This involves:

- Being profitable, with a 12 per cent return on equity

- Being financially solid, with a CET1 ratio of 16.9 per cent. Payout ratio about 50 per cent

- Being efficient. Annual cost growth in the group to be limited to 2.0 per cent within existing business

- A strengthened market position. Ambition to be no. 1 in the group’s business lines

- More satisfied customers. Ambition to have the most satisfied customers in all business lines and market areas

- Proud and committed employees. Ambition to have the most committed staff in the financial industry in Norway

- Quality in all our work

SpareBank 1 SMN has delivered high return over time and has robust customer relationships. The group will build further on this foundation. Five strategic priorities are highlighted for the strategy period:

- Create ‘One SMN’

- Increase digitalisation and use of insight

- Take a leading role in the development of Norway’s savings banks

- Integrate sustainability into the business

- Exploit the power inherent in the ownership model

In order to achieve the goals of the group strategy and to increase competitive power, a comprehensive enhancement programme termed One SMN has been initiated. One SMN is a comprehensive programme designed to enhance profitability through increased exploitation of synergies, increased incomes, cost efficiencies and improved capital utilisation.

SpareBank 1 SMN strengthens its position as the region’s leading financial group

SpareBank 1 SMN is now bringing its business lines and subsidiaries closer together in order to strengthen customer offerings, simplify processes and make SpareBank 1 SMN an even more attractive place to work. The object is to achieve profit growth of NOK 400m after tax through increased synergies, increased incomes, reduced costs and improved capital utilisation.

More efficient distribution

Customer needs are changing. Customers no longer have the same need to visit physical branches since ever more services are provided more efficiently through customer self-service. At the same time, competition in the market is intense, heightening the need for greater efficiency and profitability. To meet customers’ new needs, and to assemble the power inherent in the group’s breadth and competence, SpareBank 1 SMN is now co-locating products and services in 13 market areas, while six smaller branches are being closed.

A strong local presence remains at centre-stage for SpareBank 1 SMN. The group will therefore maintain a physical presence throughout Central Norway with 61 offices once the new office structure in place. Reinforcing specialist skills at the local level will ensure a better offering to even more customers. 90 per cent of customers will continue to have less than an hour’s journey to their nearest bank office. This consolidates SpareBank 1 SMN’s position as the region’s leading finance house.

The group’s presence as of the 31st December 2020

More power in shared functions

On 11 August 2020 SpareBank 1 SMN took an important step to infuse greater focus on customers and business when the group’s largest subsidiaries – EiendomsMegler 1 and Regnskapshuset – joined the group management team. This ensures stronger interaction and coordination across the group, and an improved ability to meet the needs of personal customers and corporate clients alike.

The group’s staff, support and development units have also been reorganised to increase efficiency and improve resource use. This makes for highly competent entities able to assist customers and business lines alike in the group. Group-wide units have been set up in several areas, among them digital and business development, data and analysis, branding, market and digital sales, HR and IT.

Need for new skills

Constantly changing customer needs and increased demands on efficiency call for a reduction in SpareBank 1 SMN’s staff. A reduction of about 100 FTEs will be carried out in the group over the course of the coming year. The reduction will mainly be seen in the bank and in the group’s staff and support units, and will be achieved on a voluntary basis. In some areas there will be a need for more, and new, skills to achieve efficiency gains and the power needed to expand market shares. This will be done through a combination of competence development, mobility within the group and new recruitment.

SpareBank 1 SMN’s organisational set-up

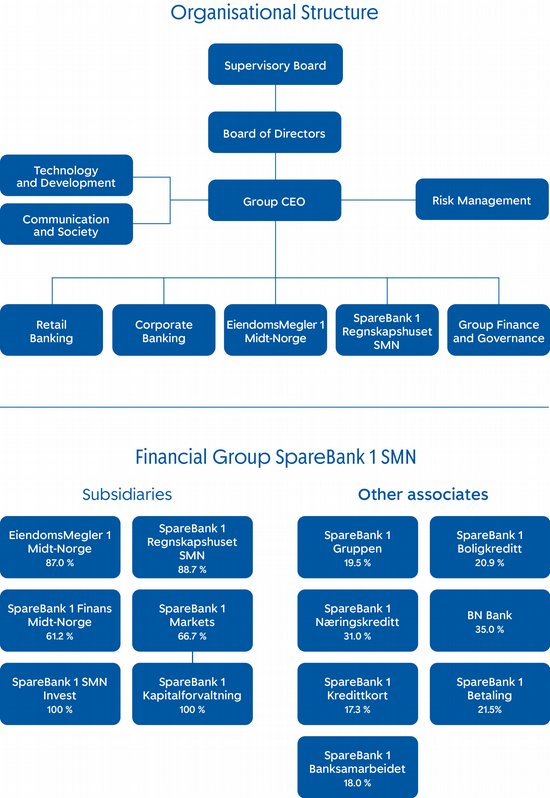

SpareBank 1 SMN is the region’s leading financial services group and one of six owners of the SpareBank 1 Alliance. Its head office is in Trondheim and the group and its subsidiaries employ 1,600 staff. SpareBank 1 SMN is a regional independent savings bank with a local footing. Through the SpareBank 1 Alliance and its own subsidiaries, SpareBank 1 SMN has secured access to competitive products in the fields of financing, savings and investment, insurance and payment services. SpareBank 1 SMN is organized under the following structure:

SpareBank 1 SMN Markets

SpareBank 1 SMN Markets AS is an investment firm offering a complete range of products. The company’s aspires to be a leading Norwegian capital market institution able in collaboration with its parent banks to deliver all capital market services. Advisory services and facilitating external and equity financing for clients are important service areas. Client trading and proprietary trading in shares and derivatives, fixed income and currency instruments along with bonds is also performed. The subsidiary SpareBank 1 Kapitalforvaltning AS offers active portfolio management. SpareBank 1 SMN owns 66.70% of the company. In 2020 the company strengthened its market position and posted considerable income growth. 2020 was marked by increased incomes in all business lines. Collaboration with the parent banks was good, and this generated incomes in all business areas. SpareBank 1 Markets has acquired a substantial position for raising capital for tech companies and companies that contribute to a sustainable economy. In total, the company participated in issues with a nominal value of NOK 37bn in these sectors. At the end of 2020 the company had 151 employees.

SpareBank 1 Kapitalforvaltning

SpareBank 1 Kapitalforvaltning manages discretionary portfolios. Portfolio management for the clients – including private individuals, businesses, foundations and municipalities – is based on a risk profile which defines the distribution between shares and interest-bearing placements. SpareBank 1 Kapitalforvaltning tailors client portfolios through tactical deviations from the long-term distribution between shares and fixed income instruments, and assists clients’ implementation through choice of mutual funds and/or direct investments in shares/bonds.

The company has established a methodology for identifying ESG-related issues and performs an independent assessment both of the individual company and the mutual fund’s compliance in this area. The focus is on exercising active ownership with a view to influencing actors’ compliance. SpareBank 1 Kapitalforvaltning has prepared an ESG report summarising this analysis to provide clients with good insight into the work done. At the start of 2021 the company manages about NOK 20bn on behalf of its clients.

SpareBank 1 Finans Midt-Norge

SpareBank 1 Finans Midt-Norge offers leasing, vendor’s lien and invoice sale services to about 38,000 retail customers and 4,000 corporate clients. The company markets its products through parent banks, car dealers and to some extent makes direct sales. SpareBank 1 Finans Midt-Norge has total assets of NOK 9.6bn and is represented in the counties of Trøndelag, Møre and Romsdal, Vestland, Vestfold and Telemark, Innlandet and Viken.

The proportion of objects financed with electric or hybrid transmissions is increasing strongly both in the case of leasing and vendor’s liens. A good 20 per cent of the retail market portfolio comprises electric or hybrid transmissions, and the share is also rising in the corporate market. SpareBank 1 Finans Midt-Norge is concerned to offer competitive products through ‘Green Financing’. The company’s credit policy sets clear guidelines as to various requirements on businesses, products and sectors. In addition, particular account of sustainability is taken in relation to objects and customers alike, and sustainability/ESG is an important aspect of the templates employed by the company when assessing creditworthiness.

SpareBank 1 SMN Invest

SpareBank 1 SMN Invest’ strategy has been to invest in regional seedcorn, venture and private equity funds, and directly in growth companies with national and international potential. The company holds shares worth NOK 468m at the end of 2020. Investing in shares is no longer part of the group’s strategy, and SpareBank 1 SMN Invest will be wound up. The portfolio will be managed together with other long-term shareholdings of the bank and be scaled back over time.

SpareBank 1 SMN Invest’s portfolio comprised 48 companies at the end of 2020. Of these, 13 report their ESG status either via their annual report, home page or in dialogues with SpareBank 1 SMN Invest. These companies account for 58 per cent of invested capital. Of the remaining portfolio, 29 companies have undergone a discretionary screening process. Ten of them are considered to make a positive contribution to attaining the sustainability goals (positive screening), while 19 are considered not to affect attainment of the sustainability goals negatively (negative screening). The remaining portfolio of six companies have neither formalised ESG reporting nor undergone screening in connection with investment.

SpareBank 1-alliansen’s companies

SpareBank 1 SMN’s has a stake of 19.5 per cent in SpareBank 1 Gruppen. SpareBank 1 Gruppen wholly owns SpareBank 1 Forsikring, ODIN Forvaltning, SpareBank 1 Factoring and Modhi Finance. SpareBank 1 Gruppen holds a 65 per cent stake in the insurer Fremtind. In addition, SpareBank 1 SMN, together with the other SpareBank1 banks, directly owns SpareBank 1 Boligkreditt, SpareBank 1 Næringskreditt, SpareBank 1 Kreditt, SpareBank 1 Betaling and BN Bank. In December 2020 it was decided that the SpareBank 1 banks should join forces to establish SpareBank 1 Forvaltning with a focus on saving. This company will comprise the subsidiaries ODIN Forvaltning, SpareBank 1 Kapitalforvaltning and SpareBank 1 Verdipapirservice.

The saving and investment committee at SpareBank 1 Gruppen evaluates the quality of saving and investment products distributed by SpareBank 1 Gruppen. The committee is responsible for an annual audit of the product portfolio.