Equity capital certificate

At the end of 2017 SpareBank 1 SMN’s equity certificate (EC) capital totalled NOK 2,597m distributed on 129,836,443 ECs with a nominal value of NOK 20 each. At the turn of the year the bank had a treasury holding of ECs totalling NOK 39,900 distributed on 1995 ECs.

| Key figures and ratios | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 |

| Quoted price | 82.25 | 64.75 | 50.50 | 58.50 | 55.00 | 34.80 | 36.31 | 49.89 | 45.06 | 21.00 |

| No. of ECs issued, million | 129.38 | 129.83 | 129.83 | 129.83 | 129.83 | 129.83 | 102.76 | 102.74 | 82.78 | 82.41 |

| Market value (NOKm) | 10.679 | 8,407 | 6,556 | 7,595 | 7,141 | 4,518 | 3,731 | 5,124 | 3,749 | 1,750 |

| Dividend per EC | 4.4 | 3.00 | 2.25 | 2.25 | 1.75 | 1.50 | 1.85 | 2.77 | 2.10 | 2.77 |

| Book value per EC | 78.81 | 73.26 | 67.65 | 62.04 | 55.69 | 50.09 | 48.91 | 46.17 | 42.11 | 38.07 |

| Profit per EC | 8.71 | 7.91 | 7.02 | 8.82 | 6.92 | 5.21 | 6.06 | 5.94 | 6.37 | 4.16 |

| Price-Earnings Ratio | 9.44 | 8.19 | 7.19 | 6.63 | 7.95 | 6.68 | 5.99 | 8.40 | 7.29 | 5.09 |

| Price-Book Value Ratio | 1.04 | 0.88 | 0.75 | 0.94 | 0.99 | 0.69 | 0.74 | 1.07 | 1.09 | 0.57 |

| Payout ratio | 50 % | 38 % | 25 % | 25 % | 25 % | 29 % | 30 % | 47 % | 34 % | 34 % |

| EC fraction | 64 % | 64.0 % | 64.0 % | 64.6 % | 64.6 % | 64.6 % | 60.6 % | 61.3 % | 54.8 % | 56.3 % |

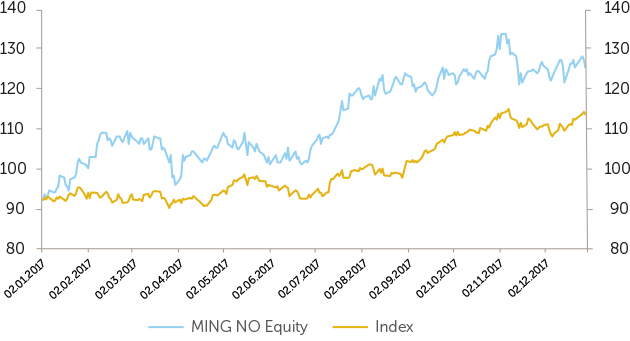

Stock price compared with OSEBX and OSEEX

OSEBX = Oslo Stock Exchange Benchmark Index (rebased equal to MING, 1 January 2017)

Dividend policy

A new act and regulations on equity certificates, which came into force on 1 July 2009, bring savings banks’ ECs more into line with shares. The new legislation entails greater equality of treatment of savings banks’ various owner groupings and minimises previous concerns related to dilution of EC holders upon payment of cash dividends.

In response to the new legislation, the following dividend policy was established in December 2009:

- SpareBank 1 SMN aims to manage the Group’s resources in such a way as to provide EC holders with a good, stable and competitive return in the form of dividend and a rising value of the bank’s equity certificate.

- the net profit for the year will be distributed between the owner capital (the EC holders) and the ownerless capital in accordance with their respective shares of the Bank’s total equity capital.

- SpareBank 1 SMN’s intention is that about* one half of the owner capital’s share of the net profit for the year should be disbursed in dividends and, similarly, that about* one half of the ownerless capital’s share of the net profit for the year should be disbursed as gifts or transferred to a foundation. This is on the assumption that capital adequacy is at a satisfactory level. When determining dividend payout, account will be taken of the profit trend expected in a normalised market situation, of external framework conditions and of any need for CET1 capital.

* The Supervisory Board resolved in 2017 to adjust the dividend policy by removing the cap on dividend payouts. The previous wording was “up to” instead of “about”.

Investor policy

The bank attaches importance to correct, relevant and timely information on the bank’s progress and financial performance as a means of instilling investor market confidence. Information is communicated to the market via quarterly investor presentations and press releases. Presentations for international partners, lenders and investors are also arranged on a regular basis.

Updated information for investors, the press and brokers is available at all times at smn.no/ir.

Ownership

SpareBank 1 SMN aims for good EC liquidity and to achieve a good spread across EC holders representing customers, regional investors and Norwegian and foreign institutions.

Previous

Previous