| Income statement NOKm |

2012 |

2011 |

2010 |

2009 |

2008 |

2007 |

2006 |

2005 |

2004 |

2003 |

| Interest income |

3,928 |

3,891 |

3,422 |

3,462 |

4,827 |

3,484 |

2,392 |

1,929 |

1,609 |

2,256 |

| Interest expenses |

2,451 |

2,499 |

2,105 |

2,137 |

3,477 |

2,345 |

1,369 |

955 |

732 |

1,385 |

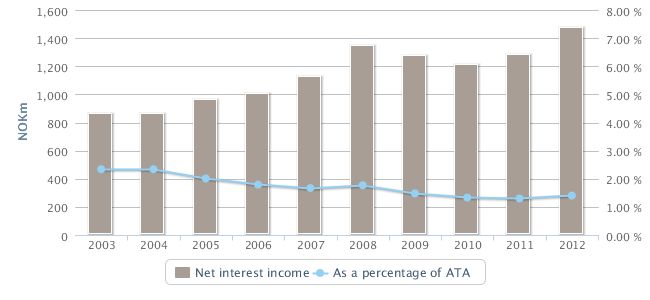

| Net interest and credit comission income |

1,477 |

1,392 |

1,317 |

1,325 |

1,350 |

1,139 |

1,024 |

974 |

877 |

871 |

| Commision and fee income |

1,139 |

919 |

855 |

756 |

610 |

671 |

580 |

537 |

443 |

332 |

| Income from investment in related companies |

244 |

248 |

276 |

349 |

393 |

233 |

190 |

119 |

23 |

-5 |

| Return on financial investements |

207 |

186 |

133 |

247 |

-186 |

99 |

229 |

157 |

42 |

74 |

| Total income |

3,067 |

2,746 |

2,582 |

2,677 |

2,167 |

2,142 |

2,022 |

1,787 |

1,385 |

1,273 |

| Salaries, fees and other personnel costs |

924 |

810 |

583 |

725 |

623 |

583 |

512 |

485 |

379 |

368 |

| Other operating expenses |

730 |

672 |

557 |

528 |

571 |

519 |

478 |

421 |

350 |

365 |

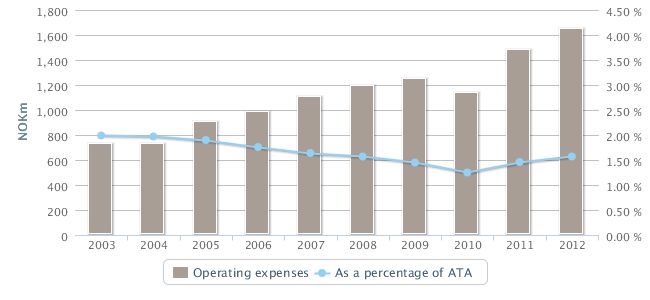

| Total costs |

1,654 |

1,482 |

1,140 |

1,253 |

1,194 |

1,103 |

990 |

906 |

729 |

733 |

| Operating profit before losses |

1,413 |

1,264 |

1,441 |

1,424 |

975 |

1,039 |

1,032 |

881 |

655 |

540 |

| Losses on loans and guarantees |

58 |

27 |

132 |

277 |

202 |

-6 |

-84 |

-38 |

81 |

229 |

| Operating profit |

1,355 |

1,236 |

1,309 |

1,147 |

773 |

1,045 |

1,116 |

919 |

574 |

311 |

| Taxes |

295 |

255 |

260 |

210 |

156 |

200 |

219 |

199 |

144 |

89 |

| Held for sale |

16 |

43 |

-27 |

- |

- |

- |

- |

- |

- |

- |

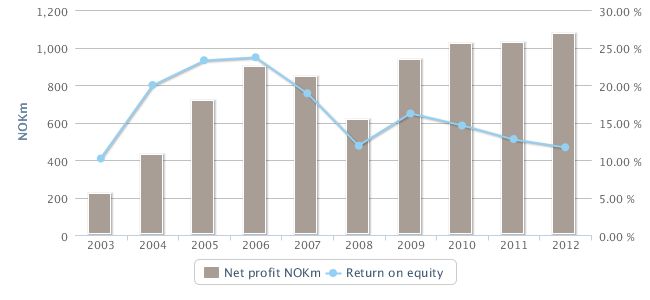

| Profit of the year |

1,077 |

1,024 |

1,022 |

937 |

617 |

846 |

898 |

720 |

430 |

222 |

| |

|

|

|

|

|

|

|

|

|

|

| Dividend |

195 |

190 |

285 |

201 |

116 |

324 |

303 |

278 |

152 |

109 |

| |

|

|

|

|

|

|

|

|

|

|

| As a percentage of average total assets |

|

|

|

|

|

|

|

|

| Net interest and credit comission income |

1.40 % |

1.30 % |

1.33 % |

1.48 % |

1.77 % |

1.67 % |

1.79 % |

2.01 % |

2.34 % |

2.34 % |

| Commision and fee income |

1.08 % |

0.86 % |

0.86 % |

0.84 % |

0.80 % |

0.99 % |

1.01 % |

1.11 % |

1.18 % |

0.89 % |

| Income from investment in related companies |

0.23 % |

0.23 % |

0.28 % |

0.39 % |

0.52 % |

0.34 % |

0.33 % |

0.25 % |

0.06 % |

-0.01 % |

| Return on financial investements |

0.20 % |

0.17 % |

0.13 % |

0.28 % |

-0.24 % |

0.15 % |

0.40 % |

0.32 % |

0.11 % |

0.20 % |

| Total costs |

1.57 % |

1.39 % |

1.15 % |

1.40 % |

1.57 % |

1.62 % |

1.73 % |

1.87 % |

1.94 % |

1.97 % |

| Operating profit before losses |

1.34 % |

1.18 % |

1.45 % |

1.59 % |

1.28 % |

1.53 % |

1.80 % |

1.82 % |

1.75 % |

1.45 % |

| Losses on loans and guarantees |

0.06 % |

0.03 % |

0.13 % |

0.31 % |

0.27 % |

-0.01 % |

-0.15 % |

-0.08 % |

0.22 % |

0.62 % |

| Operating profit |

1.28 % |

1.16 % |

1.32 % |

1.28 % |

1.02 % |

1.54 % |

1.95 % |

1.90 % |

1.53 % |

0.84 % |

| Taxes |

0.28 % |

0.24 % |

0.26 % |

0.23 % |

0.21 % |

0.29 % |

0.38 % |

0.41 % |

0.38 % |

0.24 % |

| Held for sale |

0.02 % |

0.04 % |

-0.03 % |

- |

- |

- |

- |

- |

- |

- |

| Profit of the year |

1.02 % |

0.96 % |

1.03 % |

1.04 % |

0.81 % |

1.24 % |

1.57 % |

1.49 % |

1.15 % |

0.60 % |

| |

|

|

|

|

|

|

|

|

|

|

| Balance sheet NOKm |

|

|

|

|

|

|

|

|

|

|

| Cash and loans to and claims on credit institutions |

4,091 |

4,075 |

2,532 |

1,260 |

4,548 |

3,878 |

2,323 |

2,123 |

1,541 |

1,417 |

| CDs, bonds and other interest-bearing securities |

26,100 |

21,485 |

22,949 |

19,302 |

12,035 |

7,246 |

5,602 |

4,133 |

2,566 |

2,481 |

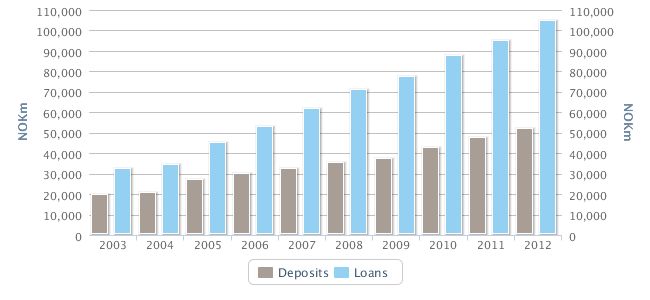

| Loans before loss provisions |

74,943 |

73,105 |

69,847 |

61,782 |

64,016 |

59,178 |

52,819 |

45,280 |

34,226 |

32,553 |

| - Specified loan loss provisions |

144 |

172 |

222 |

219 |

215 |

116 |

147 |

236 |

290 |

380 |

| - Unspecified loan loss provisions |

295 |

290 |

290 |

289 |

245 |

185 |

184 |

278 |

314 |

318 |

| Other assets |

3,224 |

3,251 |

3,177 |

2,704 |

4,540 |

1,502 |

2,765 |

3,304 |

775 |

1,123 |

| Total assets |

107,919 |

101,455 |

97,992 |

84,541 |

84,679 |

71,503 |

63,178 |

54,327 |

38,505 |

36,876 |

| |

|

|

|

|

|

|

|

|

|

|

| Debt to credit institutions |

5,137 |

6,232 |

8,743 |

11,310 |

9,000 |

5,346 |

2,766 |

1,029 |

48 |

1,114 |

| Deposits from and debt to customers |

52,252 |

47,871 |

42,786 |

37,227 |

35,280 |

32,434 |

30,136 |

27,048 |

20,725 |

19,876 |

| Debt created by issuance of securities |

35,322 |

34,192 |

33,943 |

24,070 |

29,680 |

23,950 |

21,911 |

18,036 |

13,048 |

11,361 |

| Other debt and accrued expences etc. |

2,126 |

2,122 |

1,917 |

1,876 |

2,045 |

2,265 |

1,799 |

2,876 |

822 |

769 |

| Subordinated debt |

3,040 |

2,690 |

2,758 |

3,875 |

3,156 |

2,648 |

2,383 |

1,667 |

1,347 |

1,560 |

| Total equity |

10,042 |

8,348 |

7,846 |

6,183 |

5,518 |

4,860 |

4,183 |

3,671 |

2,515 |

2,196 |

| Total liabilities and equity |

107,919 |

101,455 |

97,992 |

84,541 |

84,679 |

71,503 |

63,178 |

54,327 |

38,505 |

36,876 |

| |

|

|

|

|

|

|

|

|

|

|

| Key figures |

|

|

|

|

|

|

|

|

|

|

| Total assets |

107,919 |

101,455 |

97,992 |

84,541 |

84,679 |

71,503 |

63,178 |

54,327 |

38,505 |

36,876 |

| Average total assets |

105,500 |

98,465 |

91,317 |

86,679 |

75,820 |

67,202 |

56,434 |

47,753 |

36,965 |

36,862 |

| Gross loans to customers |

74,943 |

73,105 |

69,847 |

61,782 |

64,016 |

59,178 |

52,819 |

45,280 |

34,226 |

32,553 |

| Gross loans to customers incl. SpareBank 1 Boligkreditt |

104,909 |

95,232 |

87,665 |

77,429 |

71,317 |

61,910 |

52,819 |

45,280 |

34,226 |

32,553 |

| Gross loans in retail market |

62,587 |

55,034 |

49,619 |

45,157 |

42,679 |

38,872 |

33,808 |

29,032 |

21,491 |

20,008 |

| Gross loans in corporate market |

42,322 |

40,198 |

38,046 |

32,272 |

28,638 |

23,038 |

19,011 |

16,248 |

12,735 |

12,545 |

| Deposits from and debt to customers |

52,252 |

47,871 |

42,786 |

37,227 |

35,280 |

32,434 |

30,136 |

27,048 |

20,725 |

19,876 |

| Deposits from retail market |

22,279 |

20,860 |

19,052 |

17,898 |

17,566 |

16,070 |

15,408 |

14,080 |

11,256 |

11,252 |

| Deposits from corporate market |

29,973 |

27,011 |

23,734 |

19,330 |

17,715 |

16,363 |

13,967 |

12,968 |

9,469 |

8,624 |

| Ordinary lending financed by ordinary deposits |

70 % |

65 % |

61 % |

60 % |

55 % |

55 % |

57 % |

60 % |

61 % |

61 % |

| |

|

|

|

|

|

|

|

|

|

|

| Core capital |

9,357 |

7,856 |

7,286 |

6,730 |

4,967 |

3,703 |

3,498 |

3,073 |

2,773 |

2,474 |

| Primary capital |

10,943 |

9,055 |

8,646 |

8,730 |

7,312 |

5,560 |

4,809 |

3,808 |

3,239 |

3,407 |

| Risk weighted volume |

82,446 |

75,337 |

66,688 |

64,400 |

61,538 |

47,775 |

40,473 |

34,873 |

25,562 |

24,483 |

| Minimum requirements subordinated capital |

6,596 |

6,027 |

5,335 |

5,152 |

4,923 |

3,822 |

3,238 |

2,790 |

2,045 |

1,959 |

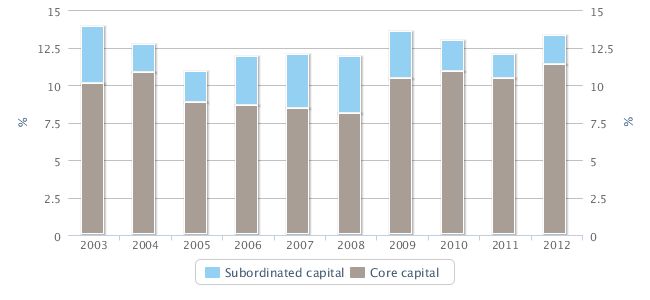

| Capital ratio |

13.27 % |

12.02 % |

12.97 % |

13.56 % |

11.88 % |

12.06 % |

11.88 % |

10.92 % |

12.67 % |

13.92 % |

| Common tier 1 ratio |

10.01 % |

8.87 % |

9.27 % |

7.67 % |

7.13 % |

7.41 % |

7.52 % |

7.48 % |

8.79 % |

7.97 % |

| Tier 1 ratio |

11.35 % |

10.43 % |

10.93 % |

10.45 % |

8.07 % |

8.41 % |

8.64 % |

8.81 % |

10.85 % |

10.10 % |

| |

|

|

|

|

|

|

|

|

|

|

| Cost/income ratio |

54 % |

53 % |

44 % |

47 % |

55 % |

51 % |

49 % |

51 % |

53 % |

58 % |

| Losses on loans |

0.06 % |

0.03 % |

0.16 % |

0.3 % |

0.2 % |

0.0 % |

-0.2 % |

-0.1 % |

0.2 % |

0.7 % |

| ROE |

11.7 % |

12.8 % |

14.6 % |

16.2 % |

11.9 % |

18.9 % |

23.7 % |

23.3 % |

20.0 % |

10.2 % |

| |

|

|

|

|

|

|

|

|

|

|

| EC price (NOK) |

34.80 |

36.31 |

49.89 |

45.06 |

21.00 |

50.28 |

56.72 |

54.46 |

38.27 |

26.72 |

| Growth in lending (gross) |

10.2 % |

8.6 % |

13.2 % |

8.6 % |

15.2 % |

17.2 % |

16.6 % |

32.3 % |

5.1 % |

4.7 % |

| Growth in deposits |

9.2 % |

11.9 % |

14.9 % |

5.5 % |

8.8 % |

7.6 % |

11.4 % |

30.5 % |

4.3 % |

4.3 % |