Corporate social responsibility

The Bank’s focus on public issues is integrated in our ongoing planning work. This ensures that ethics, the environment and important social issues are on the agenda throughout. Through the Bank’s gift fund we have for many years returned funds to the region we are a part of. This has been done through grants to talented individuals in the arts and sports, support for local associations and organisations, well-being measures at neighbourhood level and contributions to business development in Trøndelag and in Møre and Romsdal.

An active interplay between research, development, education and the business sector is important for the region’s development. Each year SpareBank 1 SMN devotes substantial resources to stimulating innovation and to bringing together industry, business and knowledge institutions. Our collaboration with the Norwegian University of Science and Technology (NTNU) and the Foundation for Scientific and Industrial Research (SINTEF), both in Trondheim, along with iKuben in Molde and Aalesund University College, is key to this effort.

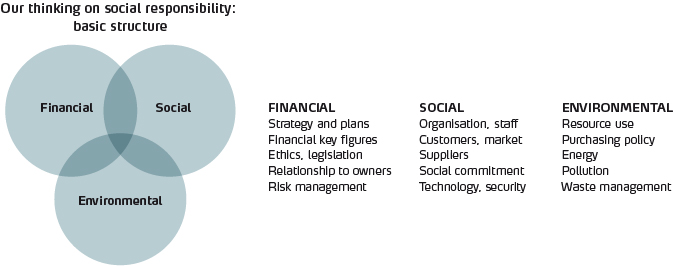

The three-part bottom line

Solid banking creates a foundation for responsible social development. As a basis for our work, we have sought a balance between the financial, social and environmental aspects of the three-part bottom line. Under each theme we have defined key areas on which we maintain a special focus, and goals and initiatives have been developed for each area.

CSR status and goal achievement 2008-2012

Parent company figures

| 2008 | 2009 | 2010 | 2011 | 2012 | ||

| Strategy/ financial | Group strategy | Updated | Continued | Continued | Continued | Continued |

| Develop CSR strategy | Established | Continued | Continued | Continued | Continued | |

| Pre-tax profit (NOKm) | 778 | 1,147 | 1,282 | 1,279 | 1,355 | |

| Total assets (NOKm) | 84,670 | 84,541 | 97,992 | 101,455 | 107,919 | |

| Return on equity | 11.9 % | 16.2 % | 14.6 % | 12.8 % | 11.7 % | |

| Core capital ratio | 8.10 % | 10.40 % | 10.90 % | 10.43 % | 11.34 % | |

| No. of ECCs issued (mill.) | 82.41 | 82.78 | 102.74 | 102.76 | 129.83 | |

| Quoted price 31.12 | 38.07 | 45.06 | 49.89 | 36.31 | 34.80 | |

| Market capitalisation (NOKm) 31.12 | 1,750 | 3,749 | 5,124 | 3,731 | 4,518 | |

| Direct return | 5.10 % | 4.60 % | 5.60 % | 5.10 % | 4.30 % | |

| No. of owners | 9,123 | 9,500 | 9,654 | 9,532 | 9,749 | |

| Knowledge of bank’s ethical rules at least 90 % | 96 % | 96 % | 96 % | 96 % | 96 % | |

| Society/social conditions | No. of FTP equivalents | 775 | 805 | 793 | 794 | 819 |

| Sickness absence | 3.84 % | 4.22 % | 4.00 % | 4.00 % | 4.60 % | |

| Women’s share of workforce | 51.5 % | 51.5 % | 51.0 % | 52.0 % | 51.9 % | |

| Women’s share of senior positions | 26 % | 28 % | 28 % | 27 % | 28.70 % | |

| Average age | 45 | 45 | 46 | 46 | 46 | |

| Employee satisfaction | 75 | 75 | I/T | 715 * | 730 * | |

| Agreement on inclusive employment | Continued | Continued | Continued | Continued | Continued | |

| Strategy on life phase policy | Continued | Further developed | Further developed | Continued | Continued | |

| Managerial development programme | Continued | Continued | Continued | Continued | Not implemented | |

| No. of offices | 56 | 56 | 54 | 54 | 51 | |

| No. of customers | 192,000 | 194,000 | 194,500 | 196,500 | 200,900 | |

| Share of internet banking customers | 54 % | 57 % | 73 % | 81 % | 95 % | |

| Share of electronic bill payments | 91 % | 92 % | 99 % | 99 % | 99 % | |

| Share allocated to culture | 22 % | 24 % | 22 % | 24 % | 17 % | |

| Share allocated to sports | 16 % | 20 % | 23 % | 23 % | 21 % | |

| Share allocated to humanitarian work | 6 % | 4 % | 6 % | 6 % | 12 % | |

| Share allocated to business development | 56 % | 52 % | 43 % | 38 % | 35 % | |

| Environment | Purchase of paper (tonnes)** | 46.5 | 35.9 | 39.1 | 35.7 | 26.9 |

| Energy consumption (kWh) | 6,193,000 | 6,580,000 | 7,004,400 | 6,900,500 | 6,135,000 | |

| No. of flights | 3,984 | 3,585 | 3,816 | 3,910 | 3,524 | |

| E-waste return scheme (tonnes) | 5.30 | 2.90 | 3.43 | 3.40 | 3.25 | |

| Waste sorting at source | Continued | Continued | Continued | Continued | Continued | |

| Printer and toner return scheme | Continued | Continued | Continued | Continued | Continued | |

| No. of videoconferencing rooms | 3 | 6 | 6 | 8 | 10 | |

| Strategy/action plan for energy and the environment at the new head office | Continued | Continued | Continued | Continued | Continued | |

| No. of offices certified under the ‘Environmental Lighthouse’ scheme | N/A | 1 | 1 | 2 | 4 |

* New system for organisational analysis as from 2011 ** Reduction of approx. 8.8 tonnes from 2011 to 2012, essentially due to switch to secure print and increased electronic communication

Environment

The Group consistently implements measures designed to reduce consumption of electricity, paper and other resources and to ensure that limits are imposed on resource-demanding travel. Handling of e-waste and purchase of environment-friendly solutions also receive much attention. The Bank strives throughout to ensure the right procurement of technological equipment. To this end, energy and environmental requirements are included as specific assessment criteria.

All technological equipment is handled as special waste, and is thereby subject to environmentally correct disposal. In 2012 3.25 tonnes of technological waste were returned. Increased use of electronic communication and the introduction of new print solutions have reduced paper consumption from 35.7 tonnes in 2011 to 26.9 tonnes in 2012.

Growing use of technological solutions imposes greater demands on safety and personal protection. The following measures are being put in place to ensure a focus on, and competence in, safety.

- Regular internal safety courses

- National safety exercises (disaster preparedness exercises)

- Free-of-charge software for enhanced customer safety

- Instructing older users in safe internet banking and in becoming more self-reliant bank customers

SpareBank 1 SMN made 3,524 business trips in 2012 compared with 3,910 in 2011. Despite increased customer activity and the bank’s involvement in committees and projects under the auspices of the SpareBank 1 Alliance, air travel has been reduced. Videoconferencing, telephone conferencing and digital tools to support teamworking and knowledge sharing are the main factors behind the reduced travel activity.

Very low energy consumption at the new head office

SpareBank 1 SMN relocated to its new head office in Trondheim in autumn 2010. Our energy consumption target was an ambitious 85 kWh per square metre for the new office premises section of the building. Measurements show energy consumption averaging below 66 kWh per square metre per year, which is far below the limit of 150 kWh per square metre set by the authorities. So far no other office building in Norway comes close to this figure. Compared with a figure above 150 kWh per square metre consumed by the old bank building, the operating expense economies are substantial. The causes of the low energy consumption are numerous and complex, but the main individual factors are:

- a well isolated and efficient building envelope

- a highly energy-efficient ventilation system

- a sophisticated control and operation-monitoring system

- organisation of the workplace and monitoring by the building's users

The principles underlying the new head office were also applied during the construction of a new SpareBank 1 SMN office in Steinkjer which was taken into use in May 2012.

Environmental lighthouse

SpareBank 1 SMN has opted for certification under ‘Environmental Lighthouse’, a national certification scheme catering to the private and public sectors. By end-2012 the Trondheim head office and the offices in Ålesund, Stjørdal and Steinkjer were duly certified. This meant that offices in which about 500 staff work on a daily basis were now certified in the following areas: work environment, procurements/materials use, energy, transport, waste, emissions and aesthetics. In 2013 the offices in Levanger, Namsos, Molde and Verdal will achieve certification and work will start on certification of ten further offices.

Ethics

The Group’s business activities are dependent on the confidence of customers, public authorities and the wider society. Staff at SpareBank 1 SMN must be recognised for their high ethical standards. To this end each of us, in any context where we are identified with SpareBank 1 SMN, must display a conduct that is perceived to be confidence inspiring, honest and trustworthy and in compliance with the norms, rules and statutes by which the society is governed.

SpareBank 1 SMN intends to provide factual, correct information in an honest, trustworthy and open manner about the Bank’s business and services.

SpareBank 1 SMN has set up the following formalised and recurring review of the Bank’s ethical guidelines vis-à-vis the Group’s employees; this, in sum, constitutes the formal framework tool for the practical conduct of all staff of the Bank.

- The ethical guidelines are a part of the staff handbook, and thus a part of the employment contract

- The ethical guidelines are reviewed at induction sessions for new staff

- Ethics is a compulsory module at the Bank’s educational facility and must be successfully completed by all staff

- Ethical guidelines are a central part of the Bank’s managerial development programme

Organisation and staff

SpareBank 1 SMN intends to be an attractive and inclusive employer for staff in all age groups and life phases. The Bank sets the stage for all staff to experience a good balance between work, home and leisure. We also encourage staff to maintain good health by promoting physical activity. This is based on the belief that staff members whose needs are catered for put in a better performance in the best interest of themselves and the enterprise.

SpareBank 1 SMN has relatively low sickness absence, and we believe this is to some extent ascribable to staff who are motivated by challenging and stimulating work at the same time as many stay in shape through various types of physical activity.

We currently have a good gender and age balance. The Bank is working to raise the proportion of women in senior positions. In 2012 28.7 per cent of senior positions were held by women (27 per cent in 2011).

The Group has established a robust framework in the trade union area:

- staff handbook, health, environment and safety (HES) handbook, inclusive employment agreement

- internal committees fixed by agreement: liaison committee, appointments committee and negotiating committee

- ethical guidelines, procedure for reporting concerns and procedure for handling conflicts

- management development programme, adviser programme and educational facility

- framework for professional development sessions

- annual staff survey

- induction sessions for new staff

- phase-of-life policy

The Group has established a project known as ‘Better Shape’ to promote good health, increased motivation and well-being. The project is a targeted drive aimed at motivating staff to raise their level of physical activity.

SpareBank 1 SMN’s monetary gifts

SpareBank 1 SMN’s gift work is based on the precept that the Bank’s monetary gifts should be non-profit, i.e. all financial support should be for the common good and benefit as many as possible. The emphasis is on awards that contribute to building, supporting and developing the region. In order to create new value and make the region an attractive place to live, we employ two main models:

- we apply a process-oriented approach in which individuals, ideas and resources are brought together to create the symbiosis that produces value creation

- we supply capital through donations to activities that promote our social objectives

We impose the same ethical and environmental demands on our partners as on ourselves. In processes, and in the case of awards of some size, written agreements are established to ensure that our social requirements are complied with. Our main focal areas are the following:

Business development:

- innovation

- competence transfer to the region’s business and industry

- assisting infrastructure development

- developing entrepreneurship

- start-up assistance (seedcorn and venture capital)

Culture/sports:

- cultural, sports, health, environmental, ethical and humanitarian purposes

- special focus on children and young people

- helping to strengthen the region’s identity and historical foundation based on the St. Olav tradition and legacy

- helping to stimulate talented individuals, young people and enthusiasts in the spheres of culture and sports

SpareBank 1 SMN disbursed almost NOK 65m to non-profit causes in 2012.