Financial summary (Group)

| Income statement NOKm | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 |

| Interest income | 4,057 | 3,825 | 3,597 | 4,031 | 4,265 | 4,118 | 3,928 | 3,891 | 3,422 | 3,462 | 4,827 |

| Interest expenses | 1,655 | 1,600 | 1,668 | 2,111 | 2,424 | 2,483 | 2,451 | 2,499 | 2,105 | 2,137 | 3,477 |

| Net interest and credit comissionincome | 2,403 | 2,225 | 1,929 | 1,920 | 1,841 | 1,635 | 1,477 | 1,392 | 1,317 | 1,325 | 1,350 |

| Commision and fee income | 2,177 | 2,005 | 1,674 | 1,545 | 1,512 | 1,463 | 1,139 | 919 | 855 | 756 | 610 |

| Income from investment in relatedcompanies | 423 | 437 | 423 | 448 | 527 | 355 | 244 | 248 | 276 | 349 | 393 |

| Return on financial investements | 334 | 322 | 521 | 11 | 193 | 147 | 207 | 186 | 133 | 247 | - 186 |

| Total income | 5,337 | 4,989 | 4,547 | 3,924 | 4,073 | 3,599 | 3,067 | 2,746 | 2,582 | 2,677 | 2,167 |

| Salaries, fees and otherpersonnel costs | 1,584 | 1,426 | 1,159 | 1,093 | 1,002 | 914 | 924 | 810 | 583 | 725 | 623 |

| Other operating expenses | 1,040 | 943 | 844 | 838 | 787 | 807 | 730 | 672 | 557 | 528 | 571 |

| Total costs | 2,624 | 2,369 | 2,003 | 1,931 | 1,789 | 1,722 | 1,654 | 1,482 | 1,140 | 1,253 | 1,194 |

| Operating profit before losses | 2,713 | 2,621 | 2,544 | 1,993 | 2,284 | 1,877 | 1,413 | 1,264 | 1,441 | 1,424 | 975 |

| Losses on loans and guarantees | 263 | 341 | 516 | 169 | 89 | 101 | 58 | 27 | 132 | 277 | 202 |

| Operating profit | 2,450 | 2,279 | 2,029 | 1,824 | 2,195 | 1,776 | 1,355 | 1,236 | 1,309 | 1,147 | 773 |

| Taxes | 509 | 450 | 352 | 383 | 376 | 393 | 295 | 255 | 260 | 210 | 156 |

| Held for sale | 149 | - 1 | 4 | - 1 | - | 30 | 16 | 43 | - 27 | ||

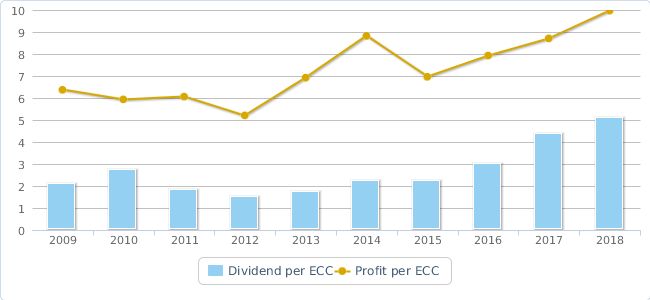

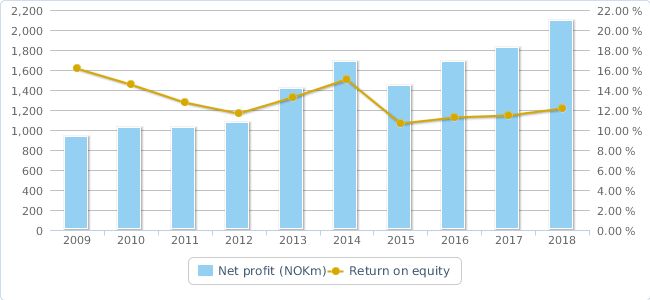

| Profit of the year | 2,090 | 1,828 | 1,681 | 1,441 | 1,819 | 1,413 | 1,077 | 1,024 | 1,022 | 937 | 617 |

| Dividend | 661 | 571 | 389 | 292 | 292 | 227 | 195 | 190 | 285 | 201 | 116 |

| Balance sheet NOKm | |||||||||||

| Cash and loans to and claims on credit institutions | 5,957 | 7,527 | 4,207 | 5,677 | 5,965 | 5,984 | 4,091 | 4,075 | 2,532 | 1,260 | 4,548 |

| CDs, bonds and other interest-bearing securities | 32,438 | 31,672 | 29,489 | 30,282 | 27,891 | 26,358 | 25,614 | 21,485 | 22,948 | 19,302 | 2,035 |

| Loans before loss provisions | 120,473 | 112,071 | 102,325 | 93,974 | 90,578 | 80,548 | 74,943 | 73,105 | 69,847 | 61,782 | 64,016 |

| - Loan loss impairments/ Specified Loan loss provisions | 744 | 765 | 632 | 183 | 172 | 173 | 144 | 172 | 222 | 219 | 215 |

| - Unspecified loan loss provisions | - | 347 | 339 | 376 | 295 | 295 | 295 | 290 | 290 | 289 | 245 |

| Other assets | 2,581 | 3,096 | 3,030 | 2,540 | 2,080 | 2,938 | 3,766 | 3,251 | 3,182 | 2,704 | 4,540 |

| Total assets | 160,704 | 153,254 | 138,080 | 131,914 | 126,047 | 115,360 | 107,975 | 101,455 | 97,997 | 84,541 | 84,649 |

| Debt to credit institutions | 9,214 | 9,607 | 10,509 | 8,155 | 9,123 | 6,581 | 7,410 | 9,118 | 13,062 | 11,310 | 9,000 |

| Deposits from and debt to customers | 80,615 | 76,476 | 67,168 | 64,090 | 60,680 | 55,927 | 52,252 | 47,871 | 42,786 | 37,227 | 35,280 |

| Debt created by issuance of securities | 47,251 | 45,537 | 40,390 | 40,569 | 39,254 | 36,806 | 33,121 | 31,306 | 29,625 | 24,070 | 29,680 |

| Other debt and accrued expences etc. | 2,671 | 1,924 | 1,532 | 1,734 | 1,095 | 1,485 | 2,070 | 2,122 | 1,922 | 1,876 | 2,045 |

| Subordinated debt | 2,268 | 2,201 | 2,228 | 2,509 | 2,417 | 2,365 | 3,040 | 2,690 | 2,756 | 3,875 | 3,156 |

| Total equity | 18,686 | 17,510 | 16,253 | 14,258 | 13,478 | 12,197 | 10,082 | 8,348 | 7,846 | 6,183 | 5,518 |

| Total liabilities and equity | 160,704 | 153,254 | 138,080 | 131,914 | 126,047 | 115,360 | 107,975 | 101,455 | 97,997 | 84,541 | 84,679 |

| Key figures | |||||||||||

| Total assets | 160,704 | 153,254 | 138,080 | 131,914 | 126,047 | 115,360 | 107,919 | 101,455 | 97,997 | 84,541 | 84,679 |

| Average total assets | 156,992 | 145,948 | 137,060 | 128,355 | 117,794 | 111,843 | 105,500 | 98,465 | 91,317 | 86,679 | 75,820 |

| Gross loans to customers | 120,473 | 112,071 | 102,325 | 93,974 | 90,578 | 80,548 | 74,943 | 73,105 | 69,847 | 61,782 | 64,016 |

| Gross loans to customers incl. SpareBank 1 Boligkreditt and SpareBank 1 Næringskreditt | 160,317 | 148,748 | 137,535 | 127,378 | 120,435 | 112,283 | 104,925 | 95,232 | 87,665 | 77,429 | 71,317 |

| Gross loans in retail market | 108,131 | 98,697 | 89,402 | 80,725 | 74,087 | 68,591 | 62,587 | 55,034 | 49,619 | 45,157 | 42,679 |

| Gross loans in corporate market | 52,186 | 50,087 | 48,133 | 46,653 | 46,348 | 43,692 | 42,322 | 40,198 | 38,046 | 32,272 | 28,638 |

| Deposits from and debt to customers | 80,615 | 76,476 | 67,168 | 64,090 | 60,680 | 55,927 | 52,252 | 47,871 | 42,786 | 37,227 | 35,280 |

| Deposits from retail market | 33,055 | 31,797 | 29,769 | 28,336 | 26,496 | 23,891 | 22,279 | 20,860 | 19,052 | 17,898 | 17,566 |

| Deposits from corporate market | 47,561 | 44,678 | 37,398 | 35,754 | 34,184 | 32,036 | 29,973 | 27,011 | 23,734 | 19,330 | 17,715 |

| Ordinary lending financed by ordinary deposits | 67 % | 68 % | 66 % | 68 % | 67 % | 69 % | 70 % | 65 % | 61 % | 60 % | 55 % |

| Ordinary lending incl. SpareBank 1 Boligkreditt and SpareBank 1 Næringskreditt financed by ordinary deposits | 50 % | 51 % | 49 % | 50 % | 50 % | 50 % | 50 % | 50 % | 49 % | 48 % | 49 % |

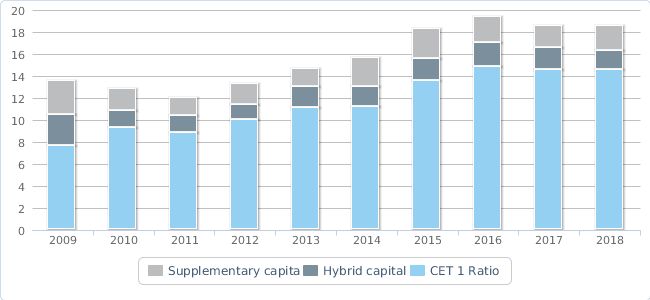

| Capital adequacy | |||||||||||

| CET1 Capital | 14 727 | 13 820 | 13 229 | 12 192 | 10 679 | 9 374 | 8 254 | 6 687 | 6 177 | 4 938 | 4 356 |

| Core capital | 16 472 | 15 707 | 15 069 | 13 988 | 12 382 | 10 989 | 9 357 | 7 856 | 7 286 | 6 730 | 4 967 |

| Primary capital | 18 743 | 17 629 | 17 185 | 16 378 | 14 937 | 12 417 | 10 943 | 9 055 | 8 646 | 8 730 | 7 312 |

| Risk weighted volume | 101 168 | 94 807 | 88 788 | 89 465 | 95 317 | 84 591 | 82 446 | 75 337 | 66 688 | 64 400 | 61 538 |

| CET 1 Ratio | 14.6 % | 14.6 % | 14.9 % | 13.6 % | 11.2 % | 11.1 % | 10.0 % | 8.9 % | 9.3 % | 7.7 % | 7.1 % |

| Core capital ratio | 16.3 % | 16.6 % | 16.9 % | 15.6 % | 12.9 % | 12.9 % | 11.3 % | 10.4 % | 10.9 % | 10.4 % | 8.1 % |

| Capital ratio | 18.5 % | 18.6 % | 19.4 % | 18.3 % | 15.6 % | 14.7 % | 13.3 % | 12.0 % | 12.9 % | 13.5 % | 119 % |

| Leverage ratio | 7.4 % | 7.2 % | 7.4 % | 6.7 % | 6.0 % | ||||||

| Cost/income ratio | 49 % | 47 % | 44 % | 50 % | 44 % | 48 % | 54 % | 53 % | 44 % | 47 % | 55 % |

| Losses on loans | 0.17 % | 0.23 % | 0.39 % | 0.14 % | 0.08 % | 0.09 % | 0.06 % | 0.03 % | 0.16 % | 0.31 % | 0.21 % |

| ROE | 12.2 % | 11.5 % | 11.3 % | 10.7 % | 15.1 % | 13.3 % | 11.7 % | 12.8 % | 14.6 % | 16.2 % | 11.9 % |

| Growth in lending (gross) | 7.8 % | 8.2 % | 8.0 % | 5.8 % | 7.3 % | 7.0 % | 10.2 % | 8.6 % | 13.2 % | 8.6 % | 15.2 % |

| Growth in deposits | 5.4 % | 13.9 % | 4.8 % | 5.6 % | 8.5 % | 7.0 % | 9.2 % | 11.9 % | 14.9 % | 5.5 % | 8.8 % |

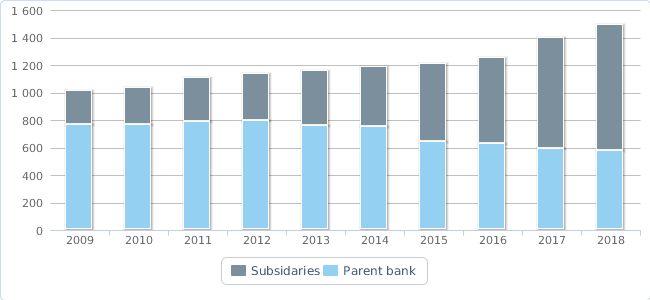

| Number of staff | 1 588 | 1 482 | 1 328 | 1 298 | 1 273 | 1 238 | 1 216 | 1 153 | 1 117 | 1 108 | 1 062 |

| Number of FTEs | 1 493 | 1 403 | 1 254 | 1 208 | 1 192 | 1 159 | 1 135 | 1 109 | 1 035 | 1 017 | 973 |

| Number of branches | 48 | 48 | 48 | 49 | 49 | 50 | 51 | 54 | 54 | 55 | 56 |

Net profit and return on equity

Capital ratio

Loans and deposits (NOKbn)

FTEs

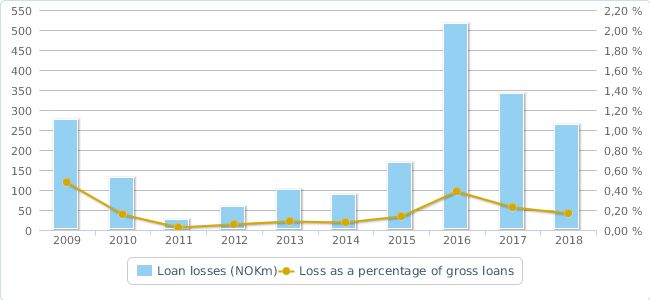

Loan losses

Dividend and profit per ECC (NOK)