Corporate social responsibility

The four core values wholehearted, responsible, likeable and competent are all connected to corporate social responsibility. However, responsible singles itself out as the most important guide for SpareBank 1 SMN’s CSR efforts.

The bank’s focus on corporate social responsibility is designed to strengthen competitiveness, reduce risk, attract good customers, investors and skilled staff, boost innovation and contribute to the further development of the region of which the Group is a part. By this means the bank creates value in a responsible and sustainable manner for all stakeholders. SpareBank 1 SMN’s ambition is to use corporate social responsibility as a competitive advantage through integrating CSR into all corporate governance and incorporating CSR in all governing documents, relevant policies and guidelines.

The bank is now reporting for the first time on the bank’s performance in the field of CSR and sustainability under the globally recognised standard, the Global Reporting Initiative (GRI), in accordance with the Core option. The bank will report its CSR results under the GRI standard on a yearly cycle together with the annual report.

Steering sustainability

SpareBank 1 SMN developed a new CSR strategy in 2017. The strategy builds on the bank’s values, is rooted in the group management team and adopted by the board of directors. The board of directors was actively involved in developing the strategy, and is a key driver in its implementation.

The strategy applies to the entire Group including the subsidiaries, and will be revised every two years. The Group executive directors are responsible for ensuring that each specialist area develops specific, measurable, relevant and timed measures that contribute to attaining the objectives of the CSR strategy. The head of corporate communications is responsible for integrating the strategy into action plans. The Group CEO has the overall responsibility for ensuring that plans and measures are acted on and implemented.

The strategy describes concrete objectives under the following themes:

- Responsible products and services

- Communication and openness

- Ethics and anti-corruption

- Environment and climate

- Staff and organisation

In addition to the specific responsibility of the Group management team, all managers are responsible for ensuring that the work on sustainable development and corporate social responsibility is relevant to the Group’s activities. The managers are also responsible for implementing adopted measures and for ensuring that all staff members within their particular area of responsibility are familiar with the measures concerned.

An annual internal control review is carried out to check compliance with and knowledge of the strategy. The result of this review is reported to the board of directors.

Involving stakeholders (GRI 102-43)

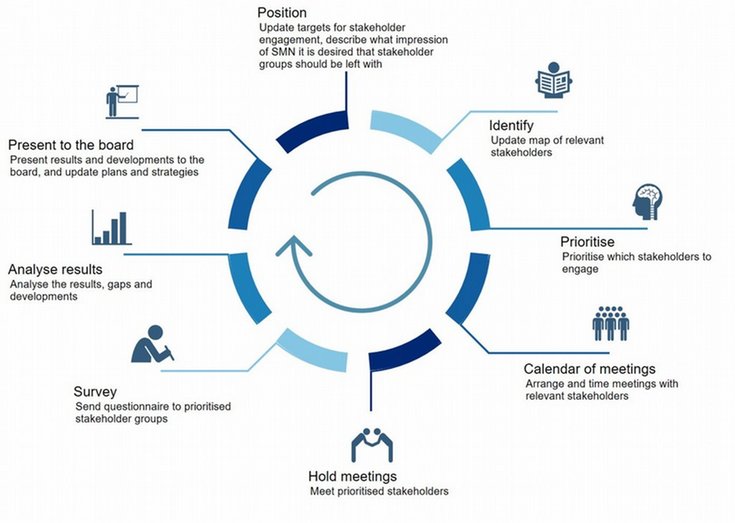

SpareBank 1 SMN’s CSR strategy defines how the bank is to engage its stakeholders. The bank endeavours on a continuous basis to identify and engage its own surroundings, and to integrate inputs into important decision processes. The bank endeavours to meet the demands and expectations of the bank’s stakeholders in an open and constructive manner. To this end the bank has an annual process devoted to stakeholder activities, rooted in the board of directors:

In its approach to stakeholder engagement, SpareBank 1 SMN shall: (GRI 102-42

- Define stakeholders on a broad and strategic basis and seek opportunities

- Prioritise stakeholders according to their value to the bank and their interest in the bank and be open about what the bank gains from the stakeholder dialogue

- Be open, clear, inquisitive and constructive in dialoguing with the stakeholders

- Seek partnerships and share success stories with the stakeholders

- Take the stakeholders’ views on board in corporate governance.

SpareBank 1 SMN engages in continuous dialogue with a number of stakeholders, and in 2017 the bank held meetings with customers, investors, mayor, county governor, the Consumer Council, the Financial Supervisory Authority of Norway, Future in our Hands, the Norwegian Confederation of Trade Unions (LO) and Finance Norway to discuss the theme of sustainability. (GRI 102-40)

This dialogue has in particular lifted the bank’s policy formulation regarding responsible investment and responsible credit practices, a theme which has been the subject of a number of discussions with Finance Norway, the Consumer Council and Future in our Hands. (GRI 102-44)

SpareBank 1 SMN will focus on themes of major importance for the bank’s external and internal stakeholders, and will support the bank’s overarching business strategy. The bank will throughout take on board the stakeholders’ legitimate expectations in the strategy process. Through the stakeholder dialogue, the bank has identified material themes, reported selected indicators on these themes and explained how it handles the themes. The bank is a part of the SpareBank 1 Alliance and, where material themes are covered by the Alliance, the report describes the Alliance’s assessments (GRI 102-46)

In its materiality process the bank defined the following themes as top priority:

- Responsible investments, negative screening and exclusion and requirements on financial suppliers

- Responsible credit practices

- Responsible marketing of products and services and good banking

- Personal data protection and information security

- Staff development

- Diversity and equal opportunity

- Ethics and anti-corruption

- Economic crime

- Developing local business

- Innovation and digitalisation

(GRI 102-47)

Reporting of CSR and sustainability

SpareBank 1 SMN devoted 2017 to professionalising the bank’s CSR efforts. The reporting process was an important aspect of this work. Inputs were received from external stakeholders, and all managers, the board of directors, the respective bank directors and the managements of the subsidiaries were involved.

The bank’s specialists obtained information on each theme of the report and the chapters are quality assured by the bank’s managers in the particular field.

The report is approved by the Group management and the board of directors, and adopted by the bank’s highest body, the supervisory board, together with the annual report.

The bank is now reporting for the first time on the bank’s performance in the field of CSR and sustainability under the globally recognised standard, the Global Reporting Initiative (GRI), in accordance with the Core option. (GRI 102-54) The bank will report its CSR results under the GRI standard on a yearly cycle together with the annual report. (GRI 102-52)

The information provided in the report is as balanced and correct as possible, and sufficiently precise and accessible to permit an evaluation of the bank’s performance as regards CSR. The report refers to management documents and makes documents in the public domain accessible via references to enable the reader to obtain further details to supplement the information offered by the report. The report is published as part of the adopted annual report to ensure timeliness and relevance. (GRI 102-46)

The GRI index can be downloaded from our webpage on corporate social responsibility

Responsible investments

One of the bank’s fundamental values is responsible-mindedness. This term implies that the bank has an extended responsibility for how its actions affect the environment, people, jobs and management of assets now and in the future. Capital is an important input factor both in ethical and unethical activity. The bank intentionally channels capital to ethical activity and away from unethical activity in order to contribute to creating a better society and to reduce risk in its own asset management. In dialogue with our stakeholders, the bank has identified active ownership, negative screening and requirements on financial suppliers as material themes which we must have under our control to ensure responsible asset management.

It is particularly important for us as a regional bank to assume a responsibility for sustainability in investments. We are duty bound to do what we can to support the UN’s sustainability goals, and we are concerned that companies in which we invest or to whom we loan money should take account of themes such as responsible management of water resources, forests, mineral extraction, responsible oil extraction and refinement of petroleum products, and fishery resources.

The bank’s geographical catchment area is Trøndelag and Møre and Romsdal. Given this geographical demarcation, investments and lending are largely restricted to companies subject to Norwegian law. However, globalisation and digitalisation have changed the context in which the bank operates. The bank has accordingly in 2017 undergone a comprehensive programme aimed at structuring its work on responsible investments.

All of SpareBank 1 SMN’s direct investments, subsidiaries and companies in which it exerts majority control are now subject to a new policy from 2017 “Our requirements on sustainability in our lending and our owner positions” and “Our principles regarding ethics, corporate social responsibility, corporate governance and sustainability in asset management”. The policies describe the criteria underlying positive and negative screening over and above statutory requirements (GRI FS11) and the bank’s requirements on its external asset managers.

The bank acts on its responsibility for customers’ and the bank’s owner interests through separate guidelines in order:

- Not to take owner positions or provide loans to companies that fail to abide by our principles, and to include caveats regarding follow-up and consequences in the event of any deviation (covenants) in funding where the companies concerned operate in industries, countries and regions posing a particularly high risk

- To exert pressure on customers and companies in which we invest to ensure that they maintain sound procedures and processes for making appropriate ethical, environmental and sustainable choices, and for influencing companies in which they hold owner positions through active owner management

- To require documentation that customers have taken action on circumstances that violate our principles

- Take the consequence of deviations that are not acted on by not renewing or prolonging loans, or by winding down owner positions.

Annually, and for the first time in April 2018, the bank will review developments in the documentation of compliance with anti-money laundering rules, requirements on transparency, ethics, corporate social responsibility, sustainability and corporate governance at small companies in which the bank holds owner positions. The bank will also check necessary measures to improve procedures and processes for following up on its owner positions. All the bank’s employees are required to annually review the bank’s policy for sustainable and ethical investments and to be aware that the bank expects all credit cases and investment decisions regarding international companies and risk industries to be accompanied by an assessment of compliance with the bank’s principles, and an account of control measures and opportunities for sanctions that are established in the event of breaches.

The bank has separate funds for liquidity purposes invested in bonds. These total about NOK 19.7bn (GRI FS11) Other assets such as derivatives, fixed interest loans, subordinated loans and equity instruments total NOK 9.5bn (GRI FS11) The bank’s ownership in subsidiaries and group companies is additional to this.

Investments at SpareBank 1 SMN can be divided into three categories:

- The bank’s own direct investments

- Investments carried out by asset management services mediated through the bank (Odin Forvaltning)

- Investments carried out by the gift fund and SpareBank 1 SMN Utvikling.

The bank endorses the United Nations-supported Principles for Responsible Investment (PRI) in all its own investments, and endeavours to ensure that the principles are also complied with by SpareBank 1 Gruppen’s companies.

Own direct investments

Subsidiaries (and companies under majority control)

SpareBank 1 SMN EiendomsMegler 1 Midt-Norge, SpareBank 1 Finans Midt-Norge, SpareBank 1 Regnskapshuset SMN, SpareBank 1 SMN Invest and SpareBank 1 Markets. SpareBank 1 Markets manages own funds with total assets of about NOK 2.2bn. The subsidiary SpareBank 1 Kapitalforvaltning managers capital on behalf of its customers and about NOK 6bn. (GRI FS11)

SpareBank 1 SMN Invest is the bank’s wholly-owned subsidiary, and manages capital of about NOK 300m. (GRI FS11) SpareBank 1 SMN Invest operates in Norway’s technology capital, Trondheim, and through SpareBank 1 SMN Invest the bank meets a further need in the local community – for local capital for technology. SpareBank 1 SMN Invest invests exclusively in unquoted equities and mutual funds in the bank’s geographical area.

Additionally, the company takes over shares in connection with bankruptcies and loan defaults in order to retain local business activity. Where required, its owner position is used to influence the company concerned to comply with the bank’s principles as regards sustainability, ethics, governance and corporate social responsibility. The bank requires evidence of a positive development in the willingness of the company concerned to comply with the bank’s principles in order to maintain its owner position. Owner positions in companies that breach the bank’s principles are followed up in the form of a half-yearly report to the board of directors until the position has been wound down. (GRI FS10)

Although new holdings are screened in accordance with the bank’s requirements, existing portfolios have yet to undergo a structured screening process. (GRI FS11) Such a process is planned for 2018. Where the subsidiaries are concerned, the bank has a continuous owner dialogue in which the bank also incorporates social or environmental themes. (GRI FS10)

The SpareBank 1 Alliance’s companies (not under majority control)

SpareBank 1 SMN holds stakes through the SpareBank 1 SMN Alliance in SpareBank 1 Forsikring, SpareBank 1 Boligkreditt, SpareBank 1 Næringskreditt, BN Bank and SpareBank 1 Gruppen.

The owner dialogue regarding responsible investments is simplified here since the other SpareBank 1 Alliance owners are savings banks with requirements and expectations similar to those of SpareBank 1 SMN. The banks coordinate their positions on social and environmental themes with these companies (GRI FS10), but the Alliance companies are not subject to the bank’s own policy.

The savings and investment committee at SpareBank 1 Gruppen carry out a quality assessment of all savings and investment products distributed by SpareBank 1 Gruppen. The committee conducts an annual audit of the product portfolio. The committee will incorporate ESG criteria in the audit in 2018.

Odin Forvaltning

Odin Forvaltning is obliged to comply with the UN’s principles for responsible investment. Odin combines ESG analyses with respect to investments with exclusion of companies that produce goods and services not in accordance with generally accepted ethical values. Odin has ongoing screening with the acknowledged research & ratings company, Sustainalytics. At Odin the managers themselves are responsible for integrating corporate social responsibility and corporate governance into investment analyses and investment decisions. Odin’s products are included in the audit done by SpareBank 1 Gruppen’s savings and investment committee. https://odinfond.no/om-oss/ansvarlig-forvaltning/

SpareBank 1 Forsikring

All but two of SpareBank 1 Forsikring’s asset managers have signed the UN’s principles for responsible investment. The company employs a broad range of instruments to ensure responsible investment of its portfolio. SpareBank 1 Forsikring describes its policy here.

Investments done by management services mediated through the bank

Odin Forvaltning delivers the bulk of the bank’s mutual fund products. This also means that the majority of mutual funds that the bank offers its own customers adhere to Odin Forvaltning’s policy for responsible investment, described in the previous chapter. As a distributor, the bank can exert influence on potential mutual fund providers through its negotiating power and through good, close dialogue with its customers. The bank cannot itself steer investment, but has at its disposal several instruments for influencing providers to follow up on their own positions so that the businesses make good choices.

Retail Banking at SpareBank 1 SMN is responsible for following up on mutual fund providers. As from 2018 the bank will oversee to what extent mutual fund providers comply with the bank’s guidelines regarding negative screening on social and environmental criteria. This work will be followed up by continuous random checks on asset managers’ products to verify compliance. As at 31 December 2017 this work had yet to commence. (GRI FS11)

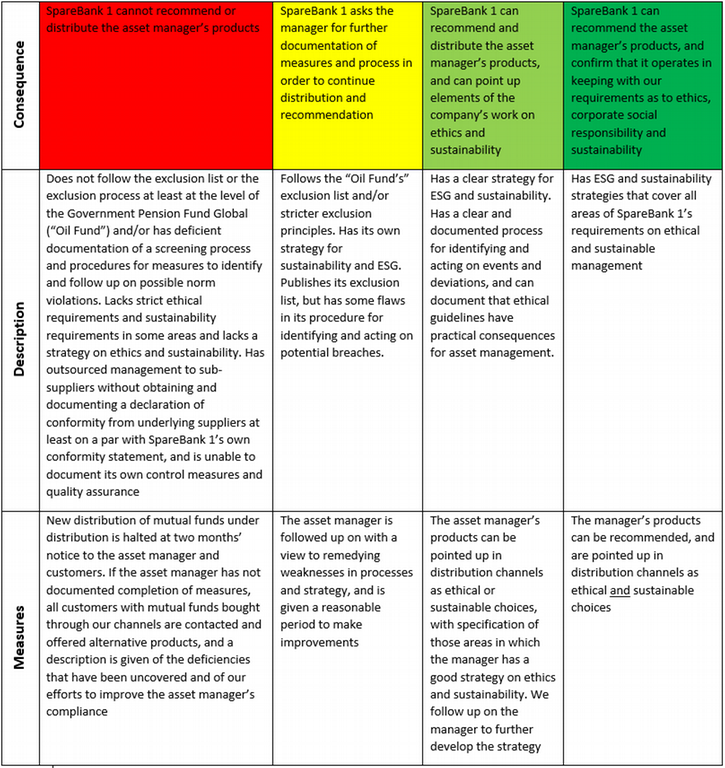

In actual practice the mutual fund managers of followed up in the manner below:

The bank is concerned to manage savings in mutual funds in a sustainable manner. This means that environmental, social and business-ethical (ESG) factors are an important aspect of the bank’s asset management. The bank aims to offer a range of sustainable mutual funds in the course of 2018. The diagram below describes the supplier chain of mutual fund products. ODIN and other fund managers put together mutual fund products with investments in selected companies. The mutual fund products are then mediated to customers through the bank.

The bank mediates asset management products to a value of NOK 5.95bn through Odin Forvaltning and NOK 4.5bn through other mutual fund providers. As at 31 December 2017 the bank delivered mutual funds from the following providers: Odin Forvaltning, DNB, Eika, Holberg, Skagen, Storebrand, Delphi, KLP and Alfred Berg. The most important products are Odin Aksje and combination funds from Odin. (GRI 102-9)

In the course of 2017 the bank has brought in the fund managers DNB, Eika, Holberg, Skagen, Storebrand, Delphi, KLP and Alfred Berg, and has not terminated any asset management collaboration. (GRI 102-10)

Investments carried out by SpareBank 1 SMN Utvikling and the gift fund

The foundation SpareBank 1 SMN Utvikling is engaged exclusively in operating appropriate investments in projects designed to support a positive development of society. Initiatives that benefit the common good. SpareBank 1 SMN Utvikling has owner positions worth NOK 60m. (GRI FS11)

The gift fund is financed by the bank’s net profit. The fund prioritises projects in the field of innovation, business development, culture, sports, the environment and humanitarian causes. The fund’s resources are in an account with the bank, and it annually donates about NOK 60m distributed fairly equally between grassroot sports, culture and business development. (GR I 201-1 aii)

SpareBank 1 SMN Utvikling and the gift fund aim to develop a societal account with indicators in the course of 2018.

Responsible credit processes

The bank aspires to be a leading actor in terms of responsible lending, and to ensure that it fills its role as a guide for the bank’s customers based on a regional and global perspective. Responsible credit processes are important in ensuring that customers do not assume commitments they are unable to service, in contributing to the bank’s support for energy transition and in providing customers with information on sustainable and competitive solutions.

The bank provides credit both to retail customers and business customers. Its approach to the two customer groups differs slightly.

Retail customers

SpareBank 1 SMN’s credit strategy is adopted by the board of directors. The basic principle of sustainable lending to the retail market is enshrined in the bank’s overall strategy for sustainability in lending, and in the bank’s credit policy with respect to retail customers. The requirements are operationalised through a credit practice manual which describes the bank’s specific requirements as regards combating money laundering and the black economy. Together with the bank’s product policy, the credit practice manual sets restrictions for non-sustainable lending. By this means the bank helps to ensure that borrowers do not take on excessive debt commitments.

The bank also discourages customers from taking out loans, based on the purpose of the loan. This applies for example to customers who desire a loan in order to send money to unknown recipients, to free up a lottery win or inheritance, or other typical types of fraud.

The credit manager for the personal market is responsible for product development and the associated sustainability. In 2017 the bank adopted a corporate social responsibility strategy which sets requirements on the development of green products, and operates credit procedures giving priority to socially responsible loans.

The bank has well established complaint procedures. Filing a complaint is a simple matter, and all complaints are handled by complaints officers. Complaints officers conduct a review of whether the bank’s policies and procedures are complied with in each case. The bank’s complaints committee also conducts a quarterly review of lessons to be learned from complaints made. The committee considers any need to revise policy, procedures, marketing or products. The steering system for the product areas is evaluated annually, and is based on complaints and events noted in the preceding year.

Socially sustainable banking services (GRI FS7)

It is particularly important for the bank as a regional bank to take on a social responsibility in the local community. The bank is known for doing this through its investments and gift fund, but it also does so through specific social products.

Access to basic banking services is imperative in a modern society. Even so, there are social groups in Trøndelag which for various reasons fall outside the scope of such services. In response, the bank has developed the product “municipal payout card”. The card is a cash card, but functions as an ordinary bank card and can be reloaded with money from one’s online bank and directly from municipal support schemes. The system can disburse benefits from the Labour and Welfare Administration (NAV) to social welfare clients, asylum seekers and refugees. Many individuals belonging to this group cannot open an ordinary bank account because they are unable to provide documentary evidence of their identity. Users of the card are spared burdensome and stigmatising trips to the bank to take out cash, often together with a support person who has to confirm their identity. The card is also popular among foreign students. The bank issued 26,548 municipal payout cards in 2017, and 42 per cent of the region’s refugees and asylum seekers utilise this service through the bank.

Children are another group that has, and should have, limited access to banking services. That is why the bank has a bank card specifically for children where the bank itself takes responsibility for any claims and for misuse. The bank issued 10,000 such cards in 2017.

The bank collaborates with the Norwegian State Housing Bank on start-up mortgages. Start-up mortgages require smaller down payments than other first-home mortgages and carry low interest. Start-up mortgages are granted to social groups in a vulnerable situation described here. In 2017 the bank granted a total of 130 start-up mortgages worth NOK 276m, corresponding to 8 per cent of the net volume of first-home mortgages.

In collaboration with the housing cooperative TOBB, the bank offers “Rent before Owning”. Many have the income needed to buy a home, but lack sufficient funds for the down payment. With “Rent before Owning” the increase in value of the flat during the rental period goes to meeting the required down payment, which is 15 per cent of the flat’s value. The value increase up to the 15 per cent requirement accrues to the tenant if the tenant chooses to buy the flat after a period. By this means a tenant has the opportunity to accumulate sufficient equity to buy the flat he/she owns, based on the increase in value of the flat during the rental period. TOBB itself accepts the risk of a house price fall. The bank sold 182 such services in 2017 to a value of NOK 0.5bn, corresponding to 3 per cent of equivalent services provided without a social profile.

SpareBank 1 SMN’s guidelines are in addition formulated such that the bank goes a long way to finding solutions other than forced sale of dwellings, and has a 60 per cent lower share of forced sales than its market share in the region would indicate. Further, the bank grants payment relief to employees affected by bankruptcies in the region. The bank granted 90 such reliefs in 2017 to a value of NOK 120,000.

Environmentally sustainable banking services (GRI FS8)

The bank also develops services with an environmental profile. In 2017 offered green loans to solar cell installations in collaboration with the power company North Trøndelag Elektrisitetsverk (NTE). In 2017 the bank granted eight such loans to a total value of NOK 970,000. In 2018 the bank is also launching favourable financing for solar cell installations, secured on residential property.

The bank also has a smart app for environment-friendly driving which reduces car insurance. The bank sold 2,515 such services in 2017 to a value of NOK 16.4m, corresponding to 5 per cent of sales.

Corporate customers

The bank gave the systematic effort to promote responsible lending to business activity a substantial boost in 2017. The board of directors has adopted a new credit strategy and new requirements on sustainability in lending: “Our requirements on sustainability in lending and owner positions”. The bank has also developed an associated guide on how staff should handle credit cases in practice, how they should assess the requirements and how they should implement the requirements in their own work.

Everyone who is involved in lending to business activity or in decisions related to the bank’s own investment decisions or those of the SpareBank 1 Alliance are required to be acquainted with the bank’s principles. They govern the purposes to which the bank lends money. The principles also govern how the bank is to act and exert its influence in shared investment decisions where the bank itself is not in a dominant position.

The bank does not wish to finance activities or projects that do not operate in keeping with the bank’s requirements, and existing corporate clients are expected to take steps to rectify any circumstances that breach these requirements. The bank is bound by loan contracts with existing clients, but any lack of action by clients to comply with the bank’s requirements entails increased risk which may result in new pricing for the borrower. The bank has imposed high requirements on sustainability in all lending, but has so far no sustainable products specifically for corporate clients over beyond those offered in the retail market. (GRI FS7 FS8)

Standard credit tools are applied in smaller credit cases. As from 2018 sustainability assessment will be incorporated in the actual credit tool by means of control points linked to sustainability. The authorisation system ensures that documentation of sustainability assessments is quality assured. In credit cases considered by the credit committees, a separate template has been prepared for assessing sustainability in lending. Assessments will also be quality assured when considered by the credit committees.

Documentation of sustainability assessments is included as a theme in the internal audit, with regular reviews of the quality of credit processes. Credit strategy with the associated document “Our requirements on sustainability in lending and owner positions” are part of a review process taking place at least annually.

Responsible marketing of products and services

Good banking requires SpareBank 1 SMN to inform the customer how best to relate to the financial products that are available. The bank accordingly goes to the fore to actively present important themes related to responsible marketing of the bank’s products.

SpareBank 1 SMN’s strategy is to illuminate challenges related to marketing. This sparks useful discussions and contributes to improvements. A pertinent example is the bank’s work on good advice on the use of personal credit and responsible lending practices, for which the bank received the Consumer Council’s acknowledgement in 2016.

SpareBank 1 SMN’s products and services, and labelling and marketing material, are developed at central level in the SpareBank 1 Alliance. The savings and investment committee in the Alliance conducts a quality assessment of labelling and marketing for the bank. The bank’s Markets division has overall responsibility for responsible marketing. The bank has a complaints arrangement readily available to its customers on the Internet, via a dedicated telephone number and the Financial Services Complaints Board. The bank has not received complaints regarding its labelling of products and services. (GRI 417-2)

Before products are launched or distributed by the bank, they are subject to a wide-ranging assessment of their impact on the target group. The bank carries out a systematic risk assessment in which it obtains independent assessments related to law, ethics and the products’ intelligibility to the target group.

When the authorities open the way for new financial services, there is a risk of unethical marketing and opportunities for good marketing. In 2017 the bank made a particular effort to promote responsible marketing of the new share saving account facility (aksjesparekonto). The bank saw that its marketing was not in keeping with its guidelines (GRI 417-3). The bank also noted that the industry in general used misleading terms such as tax deduction in relation to the scheme. The bank called for the introduction of a guide for marketing in the industry, drawing attention to the guidance previously given with respect to similar products.

Personal data protection and information security

The bank manages large quantities of customer data. In the bank’s view, personal data protection is about securing the necessary confidentiality, integrity and accessibility of all personal data that are owned, processed or managed by the bank. The quantity of information and the possibilities for its use and misuse are growing apace. The trust that we as a bank are dependent on – from customers, supervisory authorities and other stakeholders – will to an ever increasing degree rest on our secure management of customer data. We have accordingly described the bank’s commitments in detail and made them available to the bank’s stakeholders here.

Further, the bank has a specific policy and overarching guidelines for personal data protection. The guidelines help the bank to comply with requirements on treatment of personal data, both in the current personal data legislation, but also in the EU’s new General Data Protection Regulation (GDPR) which enters into force in May 2018. The guidelines describe how the bank’s treatment of personal data, roles and responsibilities in the field of personal data and how necessary documentation is made available and updated.

The bank completed phase two in the Personal Data Act project in 2017. The project improved compliance with statutory requirements. Through the project the bank established clearer descriptions of roles and responsibilities. In addition the bank put in place a more robust internal control system featuring exceptions handling and control and follow-up activities enabling us to improve our management system over time.

The bank has appointed a personal data officer to assist the Group CEO in matters of compliance with requirements on treatment of personal data. The personal data officer acts as a specialist adviser, and has responsibilities related inter alia to oversight of compliance, handling of exceptions, risk assessment and reporting any unauthorised release of personal data to the Data Protection Authority.

The bank reported one breach of the requirements regarding treatment of personal data to the Data Protection Authority in 2017. In addition the bank reported one case of outsourcing to cloud computing to Finanstilsynet (Norway’s Financial Supervisory Authority). The bank has received no complaints of personal data breaches. (GRI 418-1)

Training has been given at various levels of the organisation in 2017, both electronically and in the classroom.

The goal in 2018 is to continue the work on closing identified gaps and to secure involvement, assignment of responsibilities and training across the organisation. In addition preparations continue for the introduction of the General Data Protection Regulation both in the bank and in the SpareBank 1 Alliance. The subsidiaries are also carrying through personal data projects in 2018.

Information security

Developing a security architecture and solutions geared to a more open business model is a challenge facing the entire financial industry. SpareBank 1 SMN accordingly participates in the Alliance’s shared security strategy effort in order to address and handle the changes this development entails.

The SpareBank 1 Alliance’s Information Security Policy is the basic steering document for all processing of information in the SpareBank 1 Alliance, and builds on the Alliance’s overall security policy. The bank has a separate policy for outsourcing IT services as well as a joint security strategy that covers the entire alliance. Important decisions such as outsourcing are also considered by the board. The department of operative information security in the SpareBank 1 Alliance delivers SpareBank 1 SMN’s technical solutions, including continuous monitoring of the bank’s systems.

The ICT Regulations, compliance with which is overseen by Finanstilsynet, underlies much of the work on information security. SpareBank 1 SMN’s internal and external audit functions both review matters regulated by the ICT Regulations and best practice for information security.

A number of technical security measures have been established in this area. Training and raising of awareness are at centre stage. The bank’s competence and attitude-moulding programme for information security, Passopp, strengthens the security culture across the entire organisation, and operated again in 2017. Based on internal surveys, the bank conducts analyses and prioritises which areas Passopp will focus on in 2018.

The bank wishes to play its part in promoting safe and secure customer behaviour and in familiarising customers with information security. smn.no offers tips and advice on secure use of the bank.

Staff development

The banking market is changing. Technological progress alters customers’ behaviour and opportunities, and the bank is experiencing competition from new actors with new business models. Reorganisation, staff development and recruitment of new skills in order to build the bank for the future have high priority. The Group management team are in no doubt that staff will be the bank’s most important resource and the most important factor in marking ourselves out from our competitors. That is why the bank attaches such importance to developing competence and skills. Internal training activities are arranged on a substantial scale, and many of our talented managers and staff are offered opportunities for professional and personal development on external courses and at educational institutions.

Ensuring that the bank accommodates the changes in customer preferences and behaviour is one of the bank’s greatest challenges, and at the same time its greatest opportunity. Being a regional bank means that our staff are close to our customers, and capture new preferences, demands and wishes. Increased communication with customers on digital interfaces must maintain the same high quality as traditional advisory services. The bank seeks throughout to ensure good banking, also in its digital channels, and has a focus on developing customer advisers in both the retail and corporate areas.

The bank’s intention is to follow their customers’ life journey. A journey that at times is secure and calm, but now and then also difficult and turbulent. The bank can in many cases have a role to play in customers’ lives in turbulent periods when difficult choices are to be made. The bank plays an important role in major decisions such as buying one’s first house, saving for retirement, securing distribution of a deceased’s estate or giving advice upon break-up of marriage etc.

For corporate clients the bank is a strategic partner that facilitates establishment, growth, generational shifts and innovation in the region. The bank’s social mission is to facilitate economic development as a basis for our common welfare. This will be achieved through sound and sustainable growth. The competence of our staff has a major influence in relation to society, business and industry and private individuals. The bank’s ambition and objective is that good advisory practices should guarantee the quality of advice and customer treatment, and create predictability and stability for all stakeholders.

Systems for staff development

The SpareBank 1 Alliance has a shared digital teaching platform (LMS), which makes courses and training programmes available to staff. The bank’s own curriculums and the financial industry’s authorisation schemes form the basis for the bank’s objectives and responsibilities for developing staff competence. Together with good advisory practices, the industry’s procedures and rules, and the bank’s staff manual, provide the basis for policies, guidelines and commitments. The bank is affiliated to the authorisation scheme for financial advisers which requires certain programmes to be in place for development of the bank’s staff. Read more about the scheme here. (GRI 404-2a)

The bank conducts each year the talent development programme Developmental Management, in collaboration with the SpareBank 1 Alliance and the BI Norwegian Business School. Nine of the bank’s staff members enrolled in this programme in 2017. (GRI 404-2a)

In 2017 the bank also developed a comprehensive programme of further development for all managers. The programme started in January/February 2018 with a 360 degree evaluation of all managers. The programme includes both plenary gatherings and individual follow up of each manager based on the evaluation made and the individual’s development plan. (GRI 404-2a)

Appraisal interviews are an important instrument for assuring follow-up and development of employees. The Group’s remuneration policy document, point 4.2.5, establishes that all staff shall have appraisal interviews with their immediate superior on their personal development and performances. This also applies to staff members that are on leave. (GRI 404-3)

In 2017 the bank also worked on a new process and new tools for competence development and competence management. The project New Workday is designed to ensure that the bank, in parallel with its development and implementation of new systems and processes, develops the appropriate competence. All of the bank’s development projects utilise the new tools in order to identify competence needs and to develop targeted competence initiatives.

Reorganisation

Major changes are ongoing in the banking industry, creating a major need to revise the bank’s competence profile. In the future of the bank will need fewer staff in production, more staff in digital development and more staff in digital sales, analysis and business development. The bank has accordingly carried out a structured staff reduction process over several years, and the proportion of staff that quit in 2017 is therefore significantly higher than the number of new appointments in 2017. Staff that are affected by change, either in the form of reorganisation of work tasks or reduction of capacity, are offered a severance package. A number of employees also built up new competence by participating in development projects that qualify them for other tasks. Those who quit receive financial advice, help in making life path choices and career guidance from well-established external providers in the field. (GRI 404-2b)

The bank ended 64 employment relationships in 2017: 38 women and 26 men. Distributed by age, four were below age 30, 24 between age 30 and 50 and 36 above age 50. Total turnover involving severance packages and pension was 9.9 per cent. (GRI 401-1b) The bank concurrently acquired new competence in 2017, appointing a total of six women and ten men, of whom nine were below age 30 and seven between age 30 and 50. (GRI 401-1a)

Diversity and equal opportunity

SpareBank 1 SMN’s aim is that its staff should reflect the region’s population structure. The bank has an active focus on recruitment and promotion in order to fill any gaps and redress any imbalances in this diversity.

The industry in which the bank operates has the widest pay discrepancies in Norway between women and men with higher education. In December 2017 Statistics Norway established that women’s pay averages 69 per cent of men’s pay in the financial and insurance sector. The bank is accordingly particularly concerned to grant women and men equal opportunities for development, pay and career. Activities cover recruitment, pay and employment conditions, promotion, development opportunities and protection against harassment. Parental leave does not affect opportunities for career development or pay rises.

The Group’s remuneration policy states that the Group abides by the equal pay principle, i.e. men and women are paid identically for the same work or for work of the same value. The bank employs the digital tool FAKIS to ensure that it assigns positions of the same value to the same pay grade. At the wage settlements in 2017 guides were laid down, and funds made available, for evening out differences in pay levels between women and men. Each year the internal auditor reviews the bank’s report on compliance with the remuneration policy. The equal pay principal is also discussed with trade union representatives in connection with the annual local wage settlement.

The bank is nonetheless not satisfied with the results as regards compliance with the equal pay principle. Despite an increased focus over several years, excessive differences persist between women and men. Pay equality will accordingly remain in focus in the years ahead.

The bank’s pay differences between women and men break down as follows: (GRI 405-2)

| Type of position | Women's share of men’s remuneration |

| Mellomledelse | 99 % |

| Operative management | 89 % |

| Customer advisers | 85 % |

| Direct channel customer service centre | 93 % |

| Production | 99 % |

| Specialists and support functions | 87 % |

| Business development and digitalisation | 88 % |

Whereas the bank has most women in operative management (12 women and 5 men), men are in the majority in middle management positions (14 women and 29 men), and in the Group management team (1 woman and 5 men). (GRI 405-1). The bank is aware of the gender distribution challenge as regards managerial positions and wishes to increase the proportion of women in higher-level managerial positions. The bank has had a particular focus on increasing the proportion of female managers in recent years, but will continue to give priority to improving the gender balance in middle management and the Group management team.

The bank’s key figures for diversity break down as follows: (GRI 405-1) (GRI 102-8)

| Type of position | Women | Men | Total | ||||||

| Below 30 yrs | 30-50 yrs | over 50 yrs | Total | Below 30 år | 30-50 år | Over 50 yrs | Total | ||

| Management | 19 | 8 | 41 % | 1 | 17 | 21 | 59 % | 66 | |

| Customer advisers | 5 | 78 | 77 | 49 % | 12 | 91 | 62 | 51 % | 325 |

| Direct channel customer service centre | 8 | 14 | 3 | 52 % | 8 | 13 | 2 | 48 % | 48 |

| Production | 1 | 16 | 22 | 72 % | 3 | 12 | 28 % | 54 | |

| Specialists and support functions | 2 | 32 | 30 | 53 % | 2 | 34 | 21 | 47 % | 121 |

| Business development and digitalisation | 1 | 8 | 43 % | 2 | 9 | 1 | 57 % | 21 | |

| Supervisory Board | 4 | 9 | 41 % | 3 | 16 | 59 % | 32 | ||

| Board of Directors | 4 | 44 % | 5 | 56 % | 9 | ||||

| Permanent staff | 324 | 311 | 635 | ||||||

| Temporary staff | 10 | 5 | 15 | ||||||

| Permanent staff, full-time | 300 | 303 | 603 | ||||||

| Permanent staff, part-time | 24 | 8 | 32 | ||||||

| Contracted staff* | 26 | 52 | 78 | ||||||

*Covers various groups such as substitutes, on-call staff, expert advisers in development projects and more peripheral advisers from suppliers that need access to the bank’s systems.

Cases of discrimination are captured by the systems for the bank’s ethical guidelines described in the next chapter. The bank has not recorded cases of discrimination in 2017. (GRI 406-1). 84 per cent of the staff are on wage agreements negotiated under collective bargaining etc. (GRI 102-41)

Ethics and anti-corruption

SpareBank 1 SMN operates in an industry posing a risk of internal illegalities. In light of the nature of the business and the scale of assets that are managed, the inherent risk of internal illegalities in banking is considered to be high.

Internal illegalities may arise in the form of infiltration attempts by criminal elements, pressure exerted by staff and illegalities motivated by personal gain. Hence it is important that the bank has implemented controls to prevent and to identify irregularities. The bank must throughout maintain adequate and appropriate procedures for work sharing, restrictions and limits to authorisations, secure dual controls, satisfactory access controls and sound procedures for handling changes in IT systems.

Ethical guidelines

The bank’s ethical guidelines describe the bank’s attitudes and values with a basis in four overarching principles: confidentiality, financial independence, loyalty and personal integrity. The banks’ employees, business partners and elected officers must have a conscious awareness of the bank’s ethical guidelines in their day-to-day decisions. Each manager is duty bound to familiarise his staff with the ethical guidelines and to take up the theme in departmental meetings on a regular basis. The guidelines apply to the entire Group including the subsidiaries and are a feature of the bank’s contracts with its suppliers.

The guidelines regulate each staff member’s relationship to customers, suppliers, competitors and the world at large. Each staff member must avoid in any way entering into a relationship of dependence with the Group’s customers and business connections, and must have a conscious awareness of any of any attempt to corrupt or to offer facilitation payments. The ethical guidelines require zero tolerance of corruption, and staff members may in no circumstance receive gifts in the form of money or cash letter in the course of their work.

All new staff members are required to review the ethical guidelines as part of the introduction programme, and ethics is a theme at seminars for new staff members. The bank’s Group management team in particular and employees in general have received coaching in ethics and anti-corruption. 2017 saw the launch of the Group’s new values (wholehearted, responsible, likeable and competent) and the bank completed implementation processes in all departments in that connection. Ethics was a main theme connected to the value ‘responsible’, and various cases were taken up for discussion at department level. (GRI 205-2)

The bank adopted updated ethical guidelines in 2017. The ethical guidelines can be viewed here.

Whistleblowing

In addition to the ethical guidelines the bank has established a procedure for whistleblowing. This procedure accommodates the requirements of the Working Environment Act as regards notifying censurable circumstances at enterprises. The whistleblowing procedure is designed to reduce the risk of internal illegalities and to ensure employees’ right and duty to submit an expression of concern, or to warn about censurable circumstances.

The whistleblowing procedure cites examples of censurable circumstances that may provide a basis for expressions of concern, mentioning circumstances related to for example unprincipled conduct, corruption, illegalities, economic crime, unethical or harmful activity or violations of other ethical norms.

The whistleblowing procedure also enables employees to notify the bank’s external reception centre for whistleblowers and to report anonymously if the whistleblower so wishes.

The bank conducts an annual survey of the organisation. The survey gives respondents the opportunity to report cases of bullying and harassment in their own department. Any such instances brought to light in any department will be acted on by the HR department.

Instructions for dealing with conflicts of interest with customers were also revised and approved by the Group executive board in 2017.

Follow-up of quality deviations

The bank’s procedure for following up on quality deviations is designed to ensure a uniformity of response, reporting, filing and follow-up of censurable circumstances among employees across business lines.

The bank initiated in 2017 a process to establish a new system of event reporting in collaboration with an external supplier. The new system will be implemented in the first quarter of 2018. The system enables an improved overview of events in all areas and documentation of how the events are responded to.

The sanctions committee is responsible for following up on deviations. The committee consists of the Group legal officer, the head of lending at Corporate Banking, the head of lending at Retail Banking, the head of security and the head of HR. Sanctions are considered based on internal controls carried out in the business areas and on reported and registered deviations in general. The committee meets in principle every quarter, but acute cases can be handled as they arise.

The bank’s board of directors, Group management team and all staff have been informed of the bank’s policy on anti-corruption and its ethical guidelines. It has not however been on the Supervisory Board’s agenda. Business partners have not been specifically informed of the bank’s policy, but an annex covering corporate social responsibility accompanies all supplier contracts, and applies to the entire SpareBank 1 Alliance. Read the annex here. (GRI-2). The bank takes into account ethical issues when it enters into contracts with customers. The bank has in some cases chosen not to establish customer relationships in the real estate industry due to suspicion of social dumping. This is steered by the bank’s policy on responsible credit practices described in a separate chapter.

The bank responds in a consistent manner to violations of guidelines, and in 2017 it issued three warnings in writing as a result of two conflicts of interest and one case of sexual harassment. The bank has not witnessed dismissals/resignations, litigation or breaches of contract as a result of corruption or violations of ethical guidelines. (GRI 205-3)

Economic crime

SpareBank 1 SMN works systematically to uncover and combat economic crime. The bank’s overarching guidelines on anti-money laundering give clear guidance for SMN’s work on this theme, assigning clear-cut roles and responsibilities.

Insight into the bank and the customers’ business activities is important in ensuring a risk-based approach to economic crime and in complying with the requirements of legislation. The bank has to know which transactions are customary for the customer to undertake in order to effectively uncover unusual or suspicious transactions. Documentation must also be provided showing that the control measure is appropriate to the risk concerned. Government authorities, customers and competitors must have confidence in the bank’s professionality and integrity.

An increased degree of organised cross-border crime has changed the threat picture where economic crime is concerned. The bank notes an increase in cross-border transactions, a rising number of foreign customers, increased prevalence of virtual currency, as well as new products, new services and new actors in the banking business. In sum, money laundering, fraud and attempted fraud of the bank’s customers are becoming more widespread, and more sophisticated, year by year.

The bank seeks to ensure that its products and services are not used to criminal ends, and that its steering systems are evaluated and updated annually in step with the changing risk picture and changes in the anti-money-laundering guidelines. In addition, the bank carries out ongoing checks at various levels ranging from the business lines’ internal controls, via ongoing transaction monitoring, to controls carried out by the compliance function. Deviations and improvements are assessed on an ongoing basis, and are reported to the board of directors every quarter.

In 2017 the bank worked on operationalising new procedures and processes from the bank’s anti-money laundering project which reached completion in autumn 2016. The bank is increasingly accurate in its identification of transactions that require monitoring, and strengthened the processes for establishing customer relationships and ongoing customer due diligence. For example, the bank enquires into sources of customers’ equity capital and income, in particular where the customer has significantly upgraded a dwelling, and wishes to raise a mortgage on the value increase. In such cases the bank asks for information on and documentation of who has done the work and how the refurbishing was financed, with the intention of combating economic crime and undeclared work.

In 2017 a total of 9,191 transactions were captured by the bank’s transaction monitoring systems. All the identified transactions were examined by the bank’s own anti-money-laundering staff who reported 105 of the suspicious transactions to the National Authority for Investigation and Prosecution of Economic and Environmental Crime (Økokrim). (GRI SMN-1).

The bank also established its own clear-up projects. The clear-up projects obtain sufficient information from customer relationships established before the current know-your-customer requirements entered into force.

The bank has a focus on training to combat economic crime. All staff members are required at regular intervals to undergo mandatory e-training with respect to money laundering and terrorist financing. In addition, classroom instruction in combating money laundering is provided annually for a large number staff.

The ambition for 2018 is to further strengthen the organisation and assignment of roles and responsibilities related to anti-money laundering. The bank will take steps to ensure continued compliance with laws and guidelines when the EU’s fourth anti-money laundering directive enters into force.

In-house environment and responsible procurement

It is particularly important for us as a regional bank to assume a responsibility for sustainability in investments and lending. We are duty bound to do all we can to support the UN’s sustainability goals, and we are concerned that companies we invest in or lend money to make sustainable choices. This is described in a separate chapter.

SpareBank 1 SMN’s environment management system is certified under the ‘Environmental Lighthouse’ scheme, Norway’s most used environmental certification scheme. The bank reports its energy consumption and climate emissions each spring to the Environmental Lighthouse Foundation (Stiftelsen Miljøfyrtårn). Certification entails systematic, targeted and continuous improvement in the areas of work environment, procurements, waste, transportation, energy, emissions and aesthetics. The bank thus complies with the sustainable precautionary principle. (GRI 102-11) The bank utilises a modern environmental reporting system with frequent and consistent logging of key figures. Health, environment and safety indicators are assessed against the bank’s targets.

Consumption and climate

SpareBank 1 SMN works continuously to reduce its consumption of energy, paper, other resources and resource demanding travel. All technological equipment is handled as special waste and is delivered to an approved e-waste disposal facility. The bank strives throughout to ensure the right procurement of technological equipment and to that end includes energy and environmental requirements as specific assessment criteria. This is set out in a procurement guide and in our Environmental Lighthouse action plans.

The bank has now phased out oil-fired heating, and uses only electric power in its central heating systems, with a location-based emission factor of 0.016 kg CO2 per KWh since it is essentially a matter of renewable energy. SpareBank 1 SMN’s total energy consumption over the financial year was 5.7 GWh, down from 6.1 GWh in 2016. An express goal is to turn both the office in Steinkjer and the head office in Trondheim into, at minimum, low-energy buildings, contributing to significantly reduced energy consumption.

Norway has a dispersed population, and travel is a natural part of local banks’ working day. Travel by road and air accounts for the bulk of the bank’s climate emissions. The bank is replacing resource-demanding travel with video conferencing.

SpareBank 1 SMN’s own climate emissions arise largely from energy use and transport. The climate emissions are negligible. With emission factors from the UK’s Department for Environment, Food and Rural Affairs (Defra), and the Norwegian Water Resources and Energy Directorate’s (NVE) location-based power mix, SpareBank 1 SMN has an overall climate emission of 320 tonnes of CO2 equivalents.

Responsible procurements

The bank’s procurement policy requires all purchase contracts to include documentation of corporate social responsibility. Suppliers must at minimum abide by local, national and international laws, rules and principles (including provisions on matters such as pay, working time, health, environment, safety and anti-corruption). In the case of calls for tender and RFQs, SpareBank 1 SMN requires offerors to provide documentation of approved environmental certification.

Suppliers are subject to a notification obligation and SpareBank 1 SMN can carry out inspections and audits. Suppliers undertake to act in an ethically correct manner in their contracts for deliveries to SpareBank 1 SMN. The same requirements apply to a supplier’s sub-suppliers and any partners connected to a contract to supply SpareBank 1 SMN. Any breach of the CSR provisions is regarded as a breach of contract and could provide a basis for contract cancellation. A standard annex on CSR that underlies our procurements applies across the entire SpareBank 1 Alliance. Read the annex her.

Local business development

SpareBank 1 SMN has traditionally had a strong local footing, and an important part of SpareBank 1 SMN’s social mission is to facilitate growth and development as a basis for society’s welfare.

Through its core business, SpareBank 1 SMN covers many important needs in society: saving, credit, payment services, insurance, damage prevention, management of assets and investment. The fact that the bank operates this core business on a long-term and sustainable basis is possibly the bank’s most important contribution to local business development. Beyond its ordinary banking operations, SpareBank 1 SMN has many extraordinary initiatives with a view to developing the region in which the bank operates. SpareBank 1 SMN Invest develops local businesses by offering capital directly to new development. SpareBank 1 Invest accordingly invests exclusively in unquoted shares and mutual funds in the bank’s geographical area.

The foundation Sparebankstiftelsen SMN is a substantial owner of SpareBank 1 SMN. Its object is to preserve the social aspect of SpareBank 1 SMN’s ownership. Read more about Sparebankstiftelsen SMN.

SpareBank 1 SMN Utvikling

SpareBank 1 SMN Utvikling invests in projects designed to support a positive development of society. NOK 60m has been invested in infrastructure projects and seedcorn and venture funds. (GRI 203-1)

In addition, SpareBank 1 SMN has a social commitment that is out of the ordinary, each year supporting more than 1,000 large and small causes through the gift fund. The gift fund distributes resources to grassroot sports, culture and business development.

SpareBank 1 SMN Utvikling and the gift fund aim to put in place a societal account in the course of 2018.

Previous

Previous